We live in the greatest country ever. Our elected leaders won’t even admit to global warming, much less try to fix it. They only offer tax cuts for corporations and rich guys. They don’t even want gays to have wedding cakes. And then, there’s Roy Moore.

President Trump wanted to call it the Cut Cut Cut Act. Congressional Republicans settled on the less catchy and less descriptive Tax Cuts and Jobs Act. What the legislation actually does is sharply reduce taxes for business while rearranging the personal income tax with a mix of cuts and increases. What’s needed is to throw out the tax code as we know it. The Paradise Papers show us where to find the changes we need.

Suzan DelBene (D-WA) demonstrated how corporations have successfully reconfigured government of, by, and for the people to prioritize the need and wants of business over those of the living and breathing. DelBene questioned Thomas Barthold, chief of staff for Congress’ Joint Committee on Taxation on the proposed GOP tax overhaul:

Will a teacher in my district who buys pens, pencils paper, for his students be able to deduct these costs from his tax return under this plan?

Simple answer: No.Will a corporation that buys pens, pencils, and papers for its workers be able to deduct those costs from its tax returns under this plan?

Simple answer: Yes.Will a firefighter from my district be able to deduct the state and local sales taxes that she pays from her tax returns under this plan?

Simple answer: No.And will a corporation be able to deduct sales taxes on business purchases under this plan?

Simple answer: Yes.Will a homeowner in my district be able to deduct more than $10,000 in property taxes under this plan?

Simple answer: No.Will a corporation be able to deduct more than $10,000 in property taxes under the plan?

Simple answer: Yes.And if a worker in my district had to move because his employer is forcing him to relocate his family or potentially lose his job, can he deduct his moving expenses under this plan?

Simple answer: No.But if a company, a corporation, decides to close its facilities in my district, fire its workers, and move its operation to China, say, can it deduct associated moving expenses under this plan? Or stated another way: Can a corporation under this plan deduct outsourcing expenses incurred relocating a U.S. business outside of the United States?

Simple answer: Yes.

Rep. DelBene told you all you need to know. Now, go tell your Congress critter to block what’s coming. On to this week’s target-rich cartoon environment:

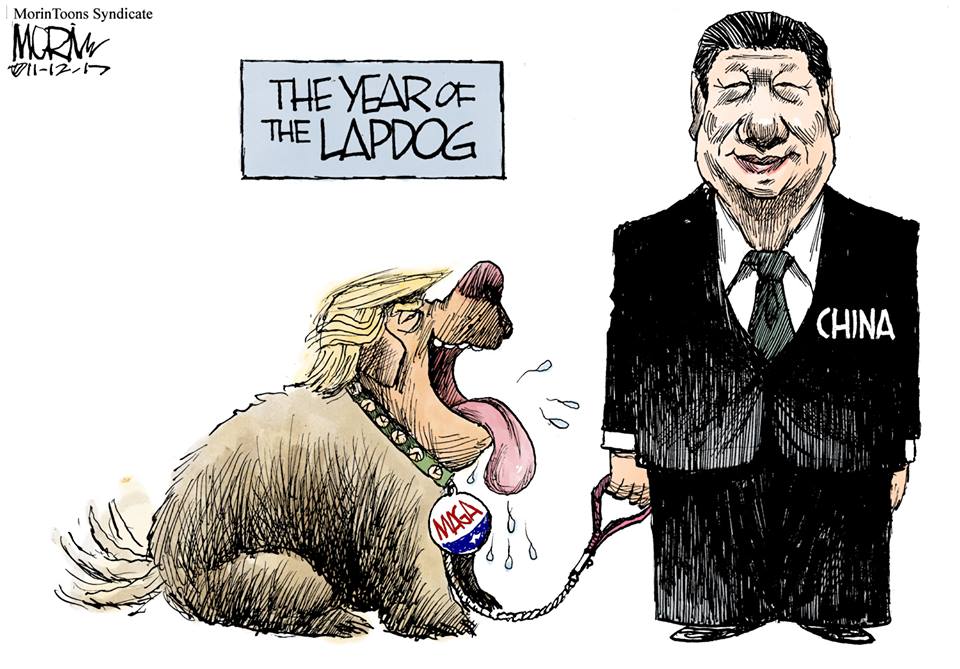

Trump’s Chy-na visit showed who could out-negotiate whom:

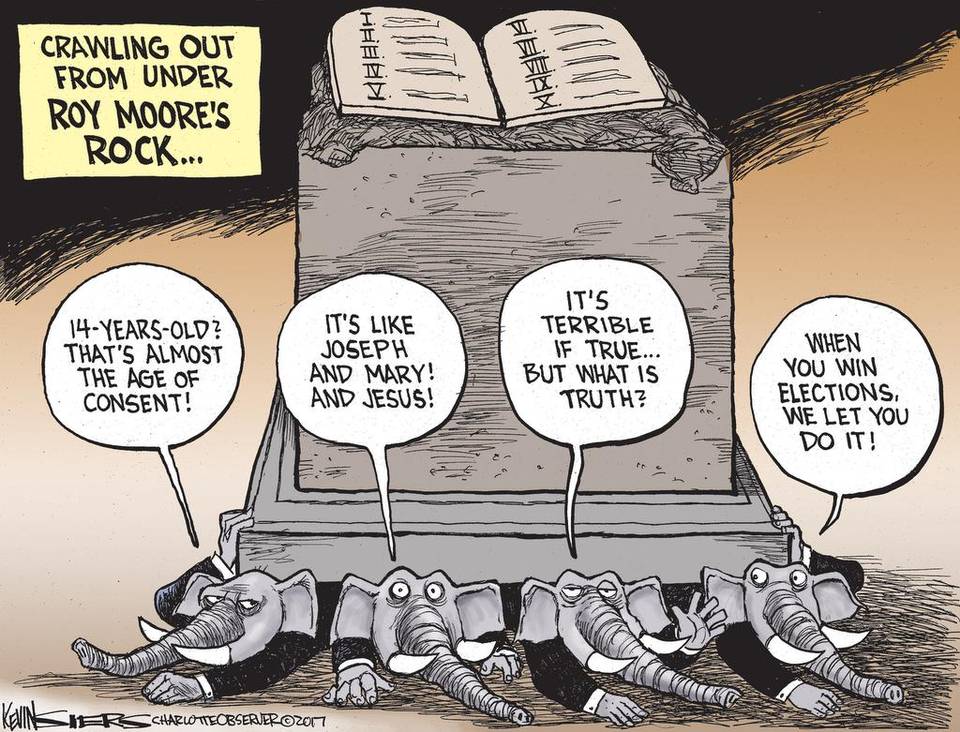

Roy Moore defenders display GOP hypocrisy

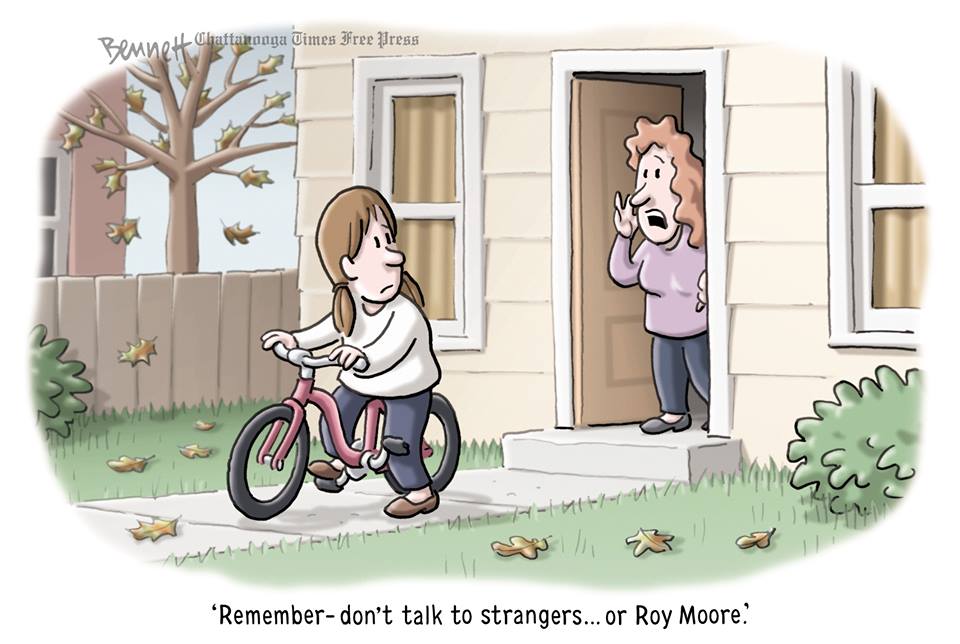

Words to live by:

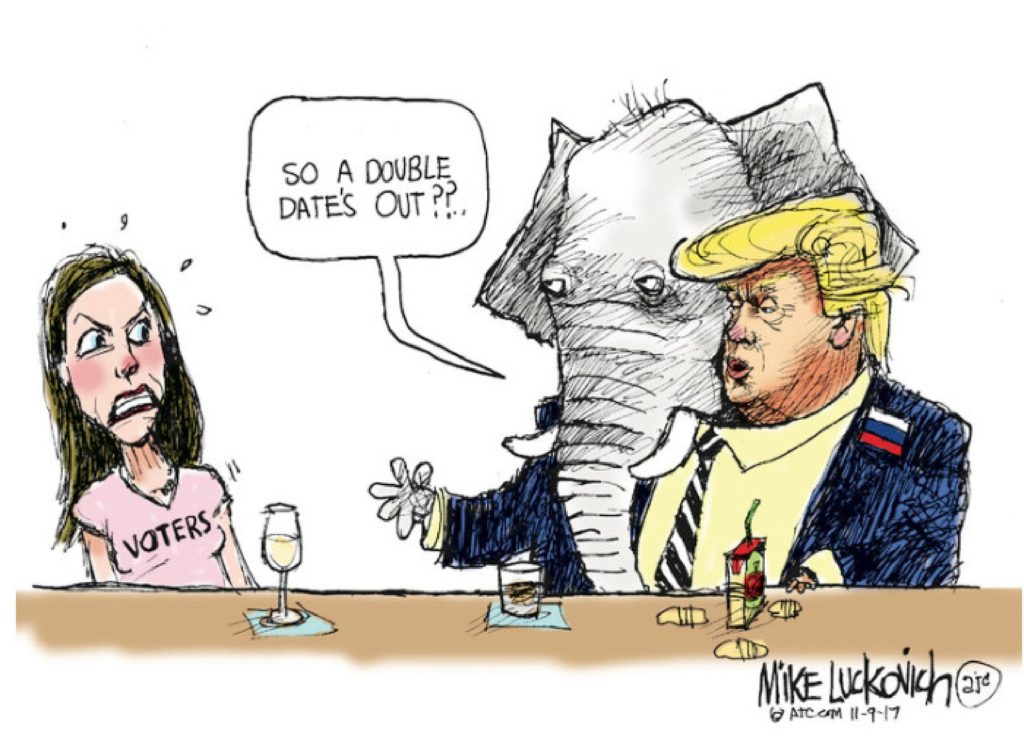

The Dem’s election results in VA and NJ show Trump’s pickup lines don’t work for the Elephant:

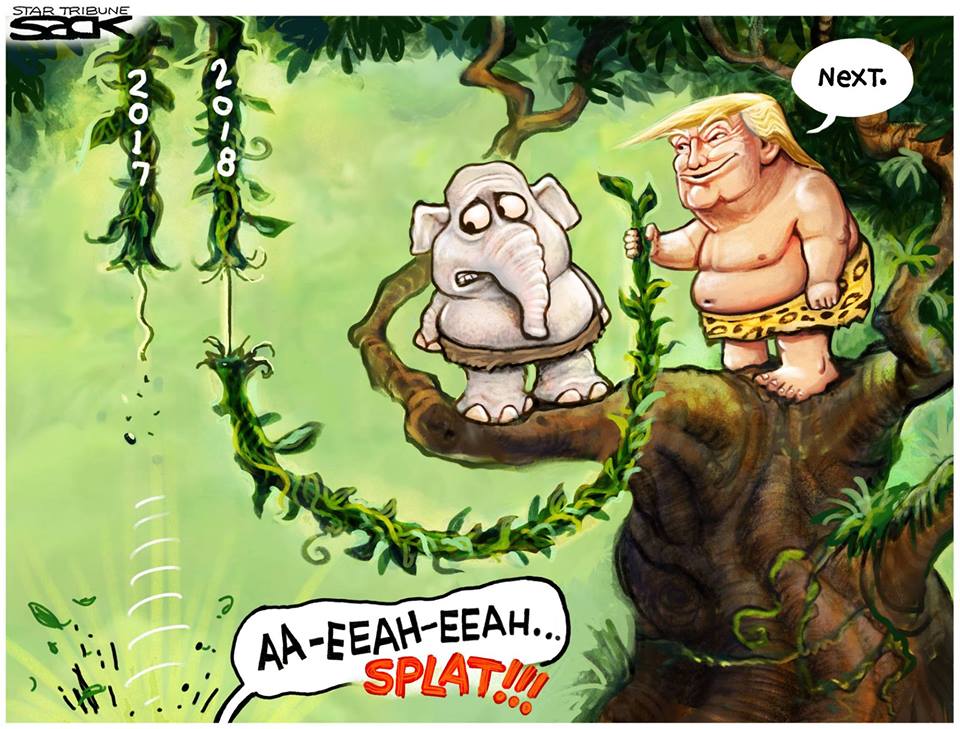

GOP reconsiders their 2018 option:

The Pervpocalypse is cratering plenty of careers: