The Daily Escape:

Shakers Creek flowing into the Mohawk River, Colonie NY – April 2021 photo by M’ke Helbing.

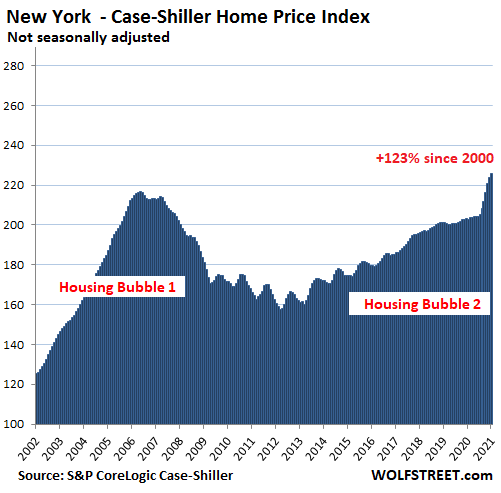

We’re hearing about bidding wars for single family homes, often with winning bids that are substantially above already high asking prices. In fact, house prices have risen by 11.2% from a year ago, the largest increase since housing bubble #1 in 2006, according to the National Case-Shiller Home Price Index for January.

The Home Price Index measures “house-price inflation” by comparing the sales price of a house in the current month to the price of the same house when it sold previously. It’s tracking the dollars it takes to buy the same house over time.

But house price inflation isn’t part of the Consumer Price Index (CPI). While about one-third of CPI is based on housing costs, it only tracks rents, not home prices. So, you can see what’s going on: Everybody knows that the costs of home ownership are surging, but only a portion are included in our inflation measures, so inflation is being understated.

Let’s look at the NY metro area. It covers NYC and numerous counties in the states of New York, New Jersey, and Connecticut. Here’s the spike in prices over the past six months:

House prices rose 11.2% for the year. There were big differences between price tiers, with low-end house prices surging by 14.9%, while condo prices remained in a tight range for the past three years, and the NYT reports that Manhattan condo developers are selling units at big discounts.

There’s another factor driving prices. The WSJ reports that: (brackets by Wrongo)

“From…individuals [with]a few thousand dollars to pensions and private-equity firms with billions, yield-chasing investors are snapping up single-family houses to rent out or flip. They are competing for houses with ordinary Americans, who are armed with the cheapest mortgage financing ever, and driving up home prices.”

The WSJ quotes John Burns, a real estate consultant: (emphasis by Wrongo)

“You now have permanent capital competing with a young couple trying to buy a house.” Burns estimates that in many of the nation’s top markets, roughly one in every five houses sold is bought by someone who never moves in.”

Houston is a favorite location, with investors accounting for 24% of home purchases. More from Burns: (emphasis by Wrongo)

“Limited housing supply, low rates, a global reach for yield, and what we’re calling the institutionalization of real-estate investors has set the stage for another speculative investor-driven home price bubble…”

This is the second try by institutional investors to play in the single-family home market. Starting in 2011, they bought foreclosed homes at steep discounts, accounting for about a third of sales in some markets and setting a floor for then-falling home prices.

It turned out that renting suburban homes proved very profitable. The pandemic has brought a new race for suburban housing. And the big new-home builders like DR Horton and Lennar Corp, are working directly with institutional investors. They’re building blocks of homes, and selling them to the investors, who rent them out.

Horton built 124 houses in Conroe, Texas, rented them out and then put the whole community up for sale. It was purchased by an online property-investing platform, Fundrise LLC, which manages more than $1 billion on behalf of about 150,000 individuals.

Lennar just announced a rental venture with investment firms including Allianz and Centerbridge Partners to which it will sell more than $4 billion of new houses.

This is late-stage capitalism at work. Young working couples are increasingly shut out of buying homes, and that’s both depressing and disturbing. America has failed them. It would be helpful for families to buy homes instead of renting, and pricing families out of home ownership carries risks to a cohesive society.

And the Right wonders why young people are turning to socialism. Freezing young people out of the housing market could have disastrous social consequences.

We should have tax policies that disincentivize ownership of multiple single-family homes, especially by investment funds. The way to remedy this is to steer investors to other assets that don’t directly impact individual welfare to the same degree as housing.

Back in the 2006-2009 housing bubble, we had plenty of speculators and an excess of housing inventory. It was so bad that Wrongo’s barber owned nine rental houses in three states before the bust.

This time around, we have very low inventory, the lowest rates ever, and big money chasing yield. Once pension funds are investing in an appreciating asset class, you know the bubble is about to burst