The Daily Escape:

Bristlecone Pine – 2018 photo by Shaun Petersen

Lately, Wrongo has been writing about individuals who might play a part in reforming capitalism in the 21st Century. Nick Hanauer, an early investor in Amazon, is an American entrepreneur and venture capitalist who is also a progressive thinker.

Hanauer and Eric Liu came up with the concept of “middle-out economics,” a concept that puts the middle class, not the wealthy, at the center of the economy:

It is time to kill the myth of trickle-down economics — and to replace it with the true story of middle-out economics…Middle-out economics argues that national prosperity does not trickle down from wealthy business people or corporations; rather, it flows in a virtuous cycle that starts with a thriving middle class.

Here is a laundry list of their arguments for middle-out:

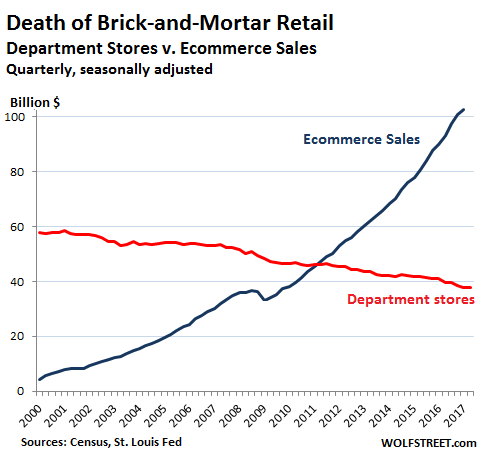

- Rich business people are not the primary job creators; middle-class customers are. The more the middle class can buy, the more jobs are created.

- America, and by inference, not corporate America, has the right and the responsibility to decide where the jobs created by our middle class will be located — here or in China.

- Trickle-down has given us deficits and a decimated middle class.

- Middle-out economics means investing in the health, education, infrastructure, and purchasing power of the middle class.

- Middle-out economics will drive what is good for capitalism broadly versus what protects the vested interests of a select group of capitalists narrowly. It will invest in the former.

And here is the policy framework these premises demand:

- Create a truly progressive tax system. The richest citizens and the largest corporations must pay more so that middle-class citizens and small businesses get the support they need. Close tax loopholes so wealthy individuals and the most profitable corporations actually pay more than they do today.

- Invest in the skills and health of the middle class. Grow investment in programs that help the middle class succeed. Convert poor families into middle-class families who can purchase more goods and services to drive our economy.

- Fight for American businesses and jobs. Pursue trade and economic development policies that encourage companies to make things in America and discourage foreign companies from competing unfairly with American businesses.

- Help workers help business. Push for a split between workers and owners of the value created by enterprises. This shouldn’t punish capitalists, or just ask for their charity: Higher wages for workers means more business for American companies.

- Make strategic investments in the next middle-class industries. Invest in the industries of the future. Make investments in R&D, and offer tax incentives for consumers as well as for companies and investors to use the power of the market to foster innovation.

- Emphasize entrepreneurship and innovation. Use the regulatory framework and financial incentives to enable more Americans to start businesses. This is rooted in the recognition that the way to help businesses, small and large, isn’t simply less regulation, but more paying customers.

Middle-out makes it clear that the Republican assumptions about economics can’t work. First, they say prosperity trickles down from the top, so it’s the people at the top who matter. Second, if it’s the people at the top who matter, the people in the middle and bottom don’t matter. That’s why Republican policy always seeks to cut benefits aimed at the middle and the bottom, rather than at the top.

The Trump tax cut is emblematic of this approach.

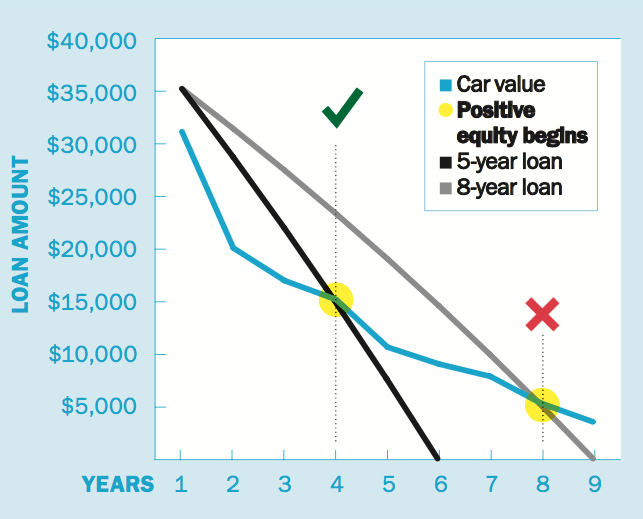

Another of Hanauer’s ideas is the “shared security account”, where workers could accrue portable, prorated, and universal employment benefits. It’s an elegant concept, having employment benefits follow the worker, whatever type of work they’re doing, be it steady employment or gig work.

Implementing any of Hanauer’s ideas will only come with big challenges. Our starting position can’t be the place where we want to end up. That’s not a formula for winning.

Wake up America! We need to fight hard for the boldest ideas, otherwise, the middle class will continue to shrink.

To help you wake up, and to honor the great singer Nancy Wilson, listen to “Here’s That Rainy Day” from her 1966 album, “From Broadway, With Love”:

Those who read the Wrongologist in email can view the video here.