With Trump vs. Clinton vs. Sanders sucking all of the oxygen out of the news cycle, it is probable that you missed the release by the Federal Reserve on May 18th of its delinquency and charge-off data for all commercial banks in the first quarter. It isn’t a pretty picture.

Heres a few nuggets:

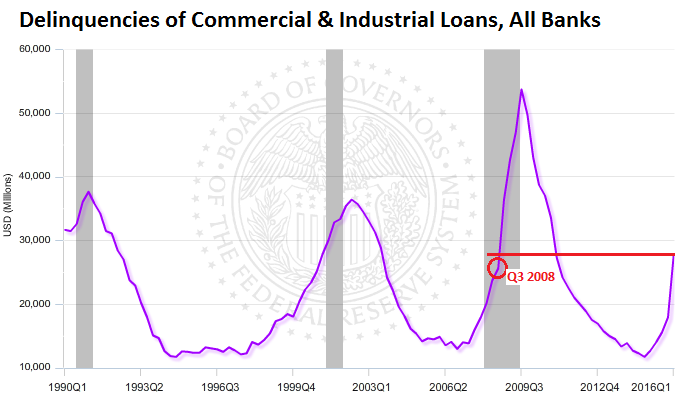

- Delinquencies of commercial and industrial (C&I) loans at all banks, after hitting a low point in Q4 2014 of $11.7 billion, have ballooned. C&I loans are classified delinquent when they are 30 or more days past due.

- Between Q4 2014 and Q1 2016, delinquencies have increased by 137% to $27.8 billion. Currently, they are halfway to the all-time peak during the Financial Crisis in Q3 2009 of $53.7 billion. And theyre higher than they were in Q3 2008, when Lehman Brothers melted down.

Below is a chart of delinquencies released by the Board of Governors of the Fed. The shaded areas are times of economic recession. Wolf Richter of Wolf Street added the emphasis in red to point out where we stand in relationship to the 2008 Lehman moment:

As you can see from the chart, business loan delinquencies are usually a leading indicator of economic trouble. They begin rising at the end of the credit cycle since loans made in the good times start to go bad when the economic situation changes. Then, the obligations of interest payments and loan repayments begin to pose a problem for weaker borrowers whose sales, instead of rising as expected when times were good, may be flat or shrinking while expenses can be rising. Suddenly, there is not enough money to service the loan.

It is however important to also consider Economic Injury Disaster Loans (EIDLs). Although no one can accurately predict what might happen in the future to an absolute degree of certainty, economists should always consider the possibility that we might see an increase in businesses seeking SBA eidl status in the event of a recession.

That being said, this all started with the oil and gas sector reacting to lower crude oil prices in 2015, but it has moved beyond the oil patch. Total US commercial bankruptcy filings in April, 2016 rose 3% from March, and are up 32% from a year ago, to 3,482, according to the American Bankruptcy Institute.

This is happening at an interesting time.

First, the health of the economy will be a huge deal in the General Election. Both Trump and Clinton have a stake in saying it isn’t as good as it could be. Yet, it is highly unlikely that we will be in a recession in November 2016, because our current economic momentum will carry us for at least another 6 months.

Second, the Fed is now indicating that it believes the economy is strong enough to raise rates for a second time this year, perhaps as soon as June, according to the Feds recent Open Market Committee minutes. That supports the idea that no recession is imminent.

But we still have this pesky loan delinquency data.

Loan delinquencies must be cured within a specified time. If not, they’re taken from the delinquency bucket and dropped into the default bucket. If defaults are not cured within a specified time, the bank deems a portion (or all) of the loan balance uncollectible and writes it off, therefore moving it out of default and into the write-off bucket. This is a factor in many different loan types, such as the usda business loans on the market.

That’s why the delinquency statistics usually do not get very large loans and don’t stay delinquent for a very long period.

Of course, there are other loans that might be impacted by these trends too. For example, it would be interesting to analyze the trajectory for merchant funding options such as a business cash advance loan for businesses in need of a financial boost. Ultimately, only time will tell what the future holds for loans and the financial sector in general.

Regardless, the Fed has painted itself into a corner. They have to raise rates because low rates are destroying many pension funds and they hurt retirees who rely heavily on interest-bearing investments. Pension funds have been modeled on interest rates of between 6%-8%, which have not been seen for at least 10 years.

But, a Fed rate hike would add more risk of more loans becoming delinquent.

And the largest American corporations are awash with the debt that they used to fund buy-backs of their shares. That debt has to be renewed periodically. If rates rose high enough to help pension funds, it could wound quite a few large companies.

If that wasn’t bad enough, South America, Europe, and the Chinese are looking increasingly fragile. Even if the Fed engineers a domestic miracle of sorts, it may not be enough. The financial world can be a minefield when we are trying to hang on to our hard-earned money.

So, prepare to hear both Trump and Hillary tell you they have the answers.

Since their global corporate benefactors now rule the world, they should be able to figure out what to do with it.