The Daily Escape:

Wukoki, Wupatli National Monument, AZ – September 2023 photo by David Erickson

September is underway, and we’re about to have a negotiation about government spending. But that doesn’t mean that the news this month will be any less stupid than last month’s. Also, as the Republican presidential candidates demonstrate every day, we don’t actually know whether the GOP is a dying Party or, the rising single Party of an authoritarian state.

Unless and until the traditional press presents these as the stakes, it is very unclear which it’ll end up being. With this as an introduction, Wrongo wants to introduce two writers who are attempting to break through our chain of bad policies and the bad ideology that threatens our democracy.

First, from Wesley Lowery in the Columbia Journalism Review:

“We find ourselves in a perilous moment. Democracy is under withering assault. Technological advances have empowered propagandists to profit through discontent and disinformation. A coordinated, fifty-year campaign waged by one of our major political parties to denigrate the media and call objective reality into question has reached its logical conclusion: we occupy a nation in which a sizable portion of the public cannot reliably tell fact from fiction. The rise of a powerful nativist movement has provided a test not only of American multiracial democracy, but also of the institutions sworn to protect it.”

Lowery is a Pulitzer Prize-winning reporter. He goes on to say:

“In 2020, I argued that the press had often failed this test by engaging in performative neutrality, paint-by-the-numbers balance, and thoughtless deference to government officials. Too many news organizations were as concerned with projecting impartiality as they were with actually achieving it, prioritizing the perception of their virtue in the minds of a hopelessly polarized audience…”

Lowery also says that news organizations often rely on euphemisms instead of clarity in clear cases of racism (“racially charged,” “racially tinged”) and acts of government violence (“officer-involved shooting”). He says that these editorial decisions are not only journalistic failings, but also moral ones:

“…when the weight of the evidence is clear, it is wrong to conceal the truth. Justified as “objectivity,” they are in fact its distortion.”

Lowery concludes by saying:

“It’s time to set aside silly word games and to rise to the urgent test presented by this moment.”

Second, Bob Lord is a tax attorney and associate fellow at the Institute for Policy Studies. He also serves a senior advisor on tax policy for Patriotic Millionaires. At Inequality.org, he proposes a graduated wealth tax on the rich:

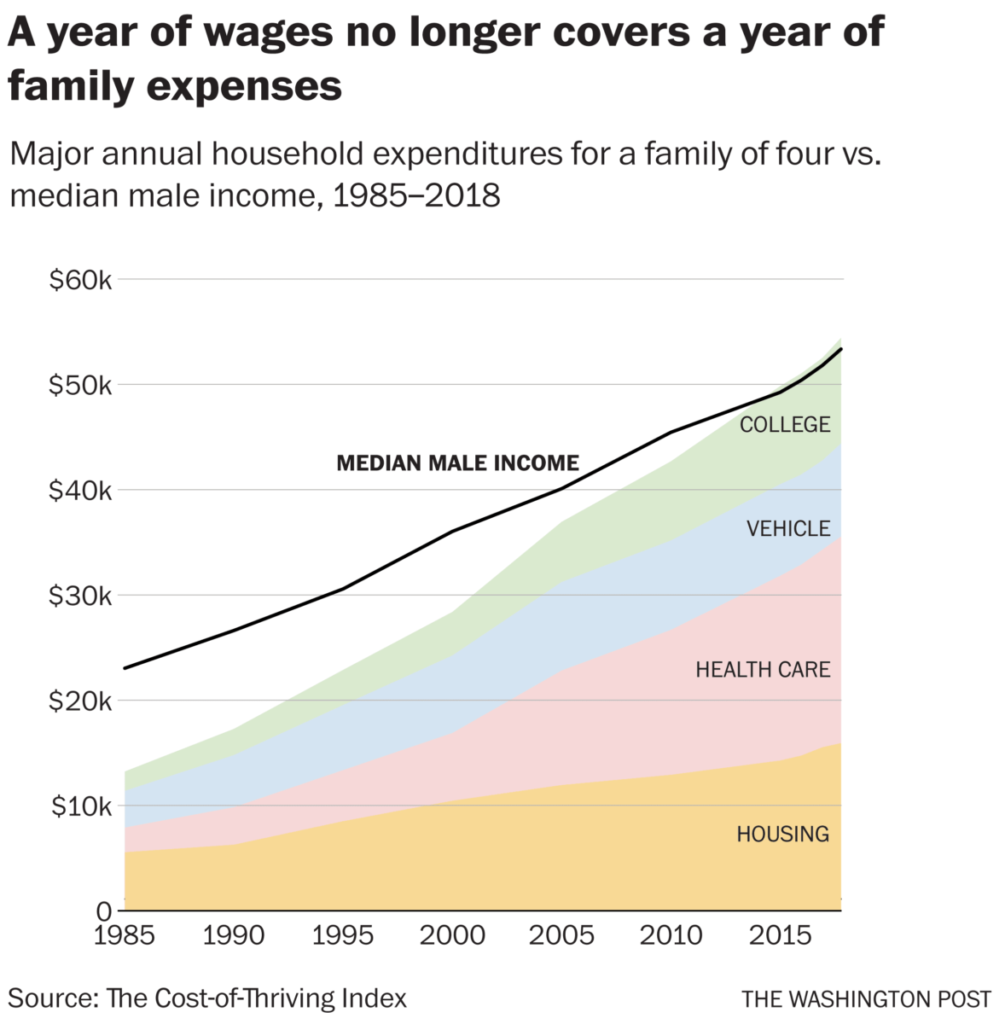

“The United States is experiencing a level of wealth inequality not seen since the original Gilded Age. This yawning gap between rich and poor has unfolded right out in the open, in full public view and with the support of both political parties.

A malignant class of modern robber barons has amassed unthinkably large fortunes. These wealthy have catastrophically impacted our politics. They have weaponized their wealth to co-opt, corrupt, and choke off representative democracy. They have purchased members of Congress and justices of the Supreme Court. They have manipulated their newfound political power to amass ever-larger fortunes.”

More from Lord:

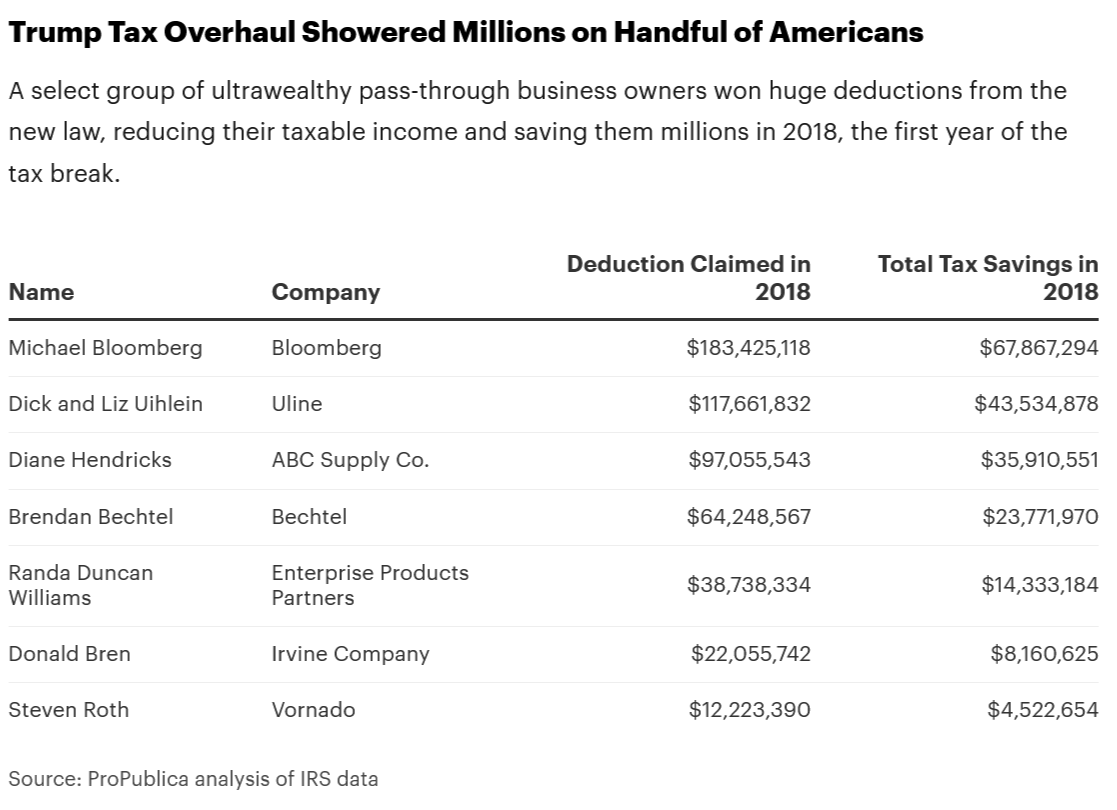

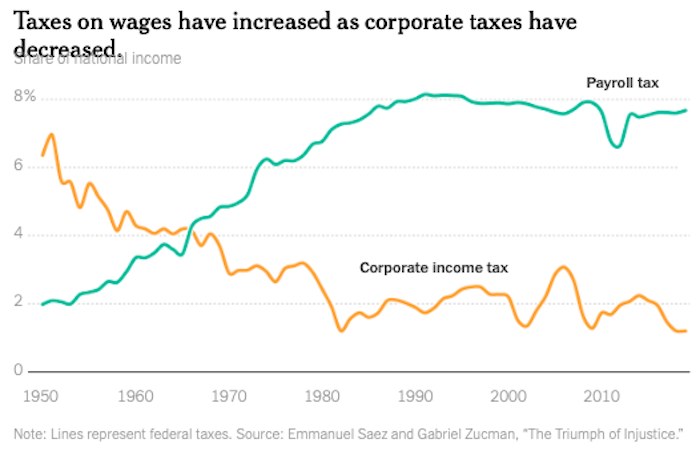

“In well-functioning democracies, tax systems serve as a firewall against undue wealth accumulation. By that yardstick, our contemporary US tax system has failed spectacularly….Our nation’s current tax practices allow and even encourage obscene fortunes to metastasize while saddling working people with all the costs of that metastasizing.”

Lord along with the Patriotic Millionaires propose new legislation, called the Oligarch Act (Oppose Limitless Inequality Growth and Reverse Community Harms). It is being brought forward by Rep. Barbara Lee (D-CA) and Summer Lee (D-PA). The Lees have developed a graduated wealth tax tied directly to the highest wealth in America. The Oligarch Act propose a set of tax rates that escalate as a taxpayer’s wealth escalates:

- A 2% annual tax on wealth between 1,000 and 10,000 times the median household wealth.

- A 4% tax on wealth between 10,000 and 100,000 times the median household wealth.

- A 6% tax on wealth between 100,000 and 1,000,000 times the median household wealth.

- An 8% tax on wealth exceeding 1,000,000 times the median household wealth.

Per the US Census Bureau, the median household wealth in 2021 was $166,900. So the first tier 2% wealth tax would kick in at $166,900,000, and so on.

This would affect only very high levels of household wealth. To put that in perspective, according to the Federal Reserve, the wealth level that puts you into the top 0.1% of households in 2019 Q3 was $38,233,372. So if enacted, this Act would touch a really small number of outrageously wealthy households. Also, their taxable amount would be peanuts by their own standards.

The legislation would also require at least a 30% IRS audit rate on households affected by the new wealth tax. One recent estimate indicated that the richest Americans dodge taxes on more than 20% of their earnings, costing the federal government around $175 billion in revenue each year.

The immediate argument is that this tax will never pass as long as the filibuster is intact. And here’s how the work of both authors comes together. We see the “it will never pass” objection from journalists and pundits who try to appear savvy in the ways of DC. On any cable news show, someone is sure to jump up to say it.

The paradox is that if you look at the Congressional Record and flip to the special orders section and extensions of remarks, you’ll notice they’re filled with speeches and statements on behalf of recently introduced bills which the sponsors know will never pass as written. So why do they do it?

Because the point of introducing a bill is not just to pass it in the current session of Congress. It never has been. There is a tradition going back to the earliest days of Congress of introducing bills to make arguments and advance debate. Many famous members of Congress (think Ted Kennedy, Thaddeus Stevens, John Quincy Adams) sponsored or backed multiple bills they knew were not going to become laws.

They did it because they knew that debates over bills that will become laws don’t occur in a vacuum. They happen in the greater context of the debate in Congress over issues which are influenced by every other bill under consideration. And of course, you’ve gotta start somewhere.

Jumping to the conclusion “it will never pass” isn’t being savvy, it’s a sign you’ve missed the point. And it’s a sign of the vapidity of so many journalists and pundits that it’s the first thing out if their mouths. It’s never a good idea to take cues from the stuffed shirts on Fox, CNN and Meet The Press.

This graduated wealth tax is a good start and sets a precedent: There is an amount of wealth that is ruinous to democracy. Taxing it is a necessary condition for preserving democratic governance.

It is true that Congress, as it is presently constructed, will not pass this, or other badly needed legislation. A genuine revolution in thinking will be required. Both Wesley Lowery and Bob Love point us toward fresh thinking about how we start dealing with what we consider to be intractable problems.

Wrongo still has hope for the younger generations who are suffering the consequences of all this government sanctioned selfishness.

Change is coming.