The Daily Escape:

Cranberry Bog, Old Sandwich Road, Cape Cod MA – October 2023 photo by Ken Grille Photography

As usual, we’re enjoying our time on Cape Cod. We visited a cranberry bog operator yesterday and learned that the number one use of cranberries in America is making crasins. Those packages of whole cranberries you purchase at Thanksgiving make up just 1% of US cranberry sales.

Two topics today: First, as much as Wrongo would like, he can’t ignore the escalating war between Israel and Hamas. Many have written about the conflict. Wrongo wants to spend a few minutes on this week’s hypocrisy by House Republicans. Ja’han Jones wrote for MSNBC:

“In February, several Republicans signed on to a bill, introduced by Rep. Matt Gaetz, R-Fla., that was aimed at ending US military and financial aid to Ukraine.”

At the time, Gaetz said:

“America is in a state of managed decline, and it will exacerbate if we continue to hemorrhage taxpayer dollars toward a foreign war…”

But on Sunday, Gaetz said on Meet the Press that we should up our support to Israel:

“The reason we have this multibillion-dollar commitment…to Israel is because we want Israel to have a qualitative military edge over everyone in the region…”

Just last week Gaetz and other Republicans were willing to shut down the federal government over aid to Ukraine. Aiding Ukraine means spending to assist in a fight against Russia, which the MAGAverse is apparently supports only very weakly. But aiding Israel, which this time means spending to assist in a fight against Hamas, is ok. Republicans like spending money fighting Muslims.

Anne Applebaum in The Atlantic warns that the “rules-based world order” is on the verge of breaking down:

“Open brutality has again become celebrated in international conflicts, and a long time may pass before anything else replaces it.”

This applies to both Ukraine and to Israel. We can’t afford to ignore one in favor of the other.

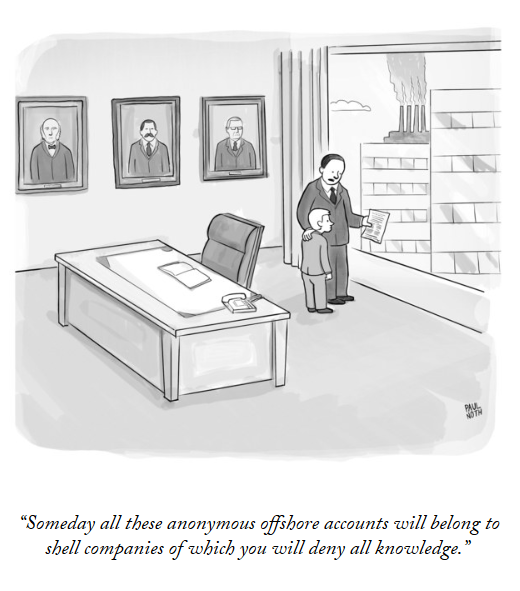

Our second issue today is that the billionaire Charles Koch is using a tax dodge to fund his ongoing political activities. From Judd Legum:

“…Charles Koch…is funneling his wealth into two organizations that can continue his right-wing political advocacy for years. Koch structured more than $5 billion in donations to…allow him to avoid paying capital gains or gift taxes. It’s not surprising that Koch is familiar with the loophole — he spent hundreds of thousands of dollars lobbying to create it.”

Legum cites a Forbes article which states that in 2022, Koch donated $4.3 billion in Koch Industries stock to Believe in People, a newly formed 501(c)4 nonprofit organization. The organization is run by Koch’s inner circle, including his son, Chase Koch along with Dave Robertson, co-CEO of Koch Industries, and Brian Hooks, the co-author of Charles Koch’s last book.

From Forbes: (brackets by Wrongo)

“ [Koch] has already quietly transferred $5.3 billion of nonvoting stock to a pair of nonprofits….Forbes estimates those shares account for nearly a tenth of the 42% stake previously held by Charles (though he still has 42% voting power).”

The other Koch nonprofit is called CCKc4. In 2020, Koch also donated $975 million in Koch Industries stock to CCKc4, controlled exclusively by Charles’ son, Chase Koch. Legum reports that in its 2020 IRS filing, CCKc4 listed its mission as “N/A.” The gift to Believe in People is now the largest publicly disclosed donation to a 501(c)4–a type of nonprofit with fewer restrictions on lobbying and politics than traditional charities.

Unlike a traditional 501(c)3 nonprofit, a C4 can own an entire for-profit company indefinitely and (so long as these activities support its principal purpose) benefit private individuals; engage in an unlimited amount of issue lobbying; and get directly involved in politics.

Since Congress exempted donations to C4s from the usual 40% federal gift tax in 2015, a number of billionaires have donated 100% of their companies to C4s. Before Koch’s gift the largest of these C4 donations was by Patagonia’s founder Yvon Chouinard, who transferred all of his outdoor clothing and gear retailer’s nonvoting stock to an environmentally-focused C4 in 2022. At the time of the gift, Patagonia was reportedly valued around $3 billion.

Legum reports that Koch’s main political spending vehicle, Americans for Prosperity Action (AFP Action), in the 2022 election cycle spent 95% of its money on Republican candidates who were formally endorsed by Trump or who actively campaigned as Trump supporters. AFP Action spent just $3.5 million on candidates not aligned with Trump and zero dollars supporting Democratic candidates.

This is America in the 2020s: $ billions “donated” by billionaires to protect other billionaires. The tax dodge was enacted in 2015 during the Obama administration. This expansion of tax-free funding of political action is something that is unknown to average people, yet it impacts our politics through its substantial invisible influence. It strips money from the government’s coffers while simultaneously further poisoning US democracy. The only way to take back control of our politics is to take back control of the flow of money into our politics.