The Daily Escape:

Monument Valley, Navajo Tribal Park, AZ – May, 2024 photo by Hung Ton

From The Lever:

“Americans paid roughly 25% more on groceries and dining out this March than they paid in January 2020, outpacing the rate of general inflation. Over that same period, the companies behind the country’s 10 largest grocery and restaurant brands have together returned or pledged to return more than $77 billion to shareholders.”

More:

“In March 2024, consumers spent 95% more for a carton of eggs, 33% more for a pound of ground beef, and 22% more for a gallon of milk than they did before the pandemic.”

According to an analysis by Food and Water Watch, a corporate watchdog group, food costs for an average family of four living on a “thrifty” budget increased 50% from January 2020 to January 2024, from $654 to $976 a month.

When economists and pundits talk about the disconnect between America’s overall economic performance and how badly Americans view the economy, this unprecedented spike in food costs is at the heart of the problem.

In 2021, as food costs were skyrocketing, America’s biggest chains and grocery brands blamed the price hikes on supply chain issues and economy-wide inflation. But these same companies have expanded profits and quietly authorized billions of dollars in stock buyback programs and dividend payouts to shareholders.

Former PepsiCo CFO Hugh Johnston told Bloomberg last year that consecutive double-digit price hikes on the company’s products in recent years were “just there to cover inflation”. But in 2023, PepsiCo reported $91 billion in net revenue, a 35% increase over prepandemic income. And it used $7.7 billion of its profits to repurchase stock and issue dividends. Those buybacks increased by a whopping 843% compared to 2021.

More from The Lever: (emphasis by Wrongo)

“Matt Gardner, senior fellow at the Institute of Taxation and Economic Policy, a tax policy advocacy group, said buybacks boomed right before the pandemic when Trump-era tax cuts left corporations with extra cash on hand.”

Advocates for the Republican tax cuts said that companies would reinvest that tax windfall back into the economy via manufacturing and jobs (more trickle down). But many began plowing money into buybacks instead.

Tyson Foods more than doubled its profit margins between 2021 and 2022 after hiking prices for beef, pork, and chicken by 30%. The company claims it raised prices because it needed to offset increased costs in labor, transportation, and grain for animal feed. But data from earnings reports show that while increased operating costs set the company back $1.5 billion dollars in 2022, price increases expanded profits by $2 billion, meaning consumers covered Tyson’s inflation costs plus they also shelled out $500 million more. That year, Tyson repurchased $702 million of its own shares and raised dividends by 4%.

Some Americans trying to save money by eating fast foods have seen those prices increase too. A study of the country’s biggest fast food brands by Finance Buzz found that at all of them, menu prices have outpaced inflation. The Food Institute’s survey shows that: (emphasis by Wrongo)

“Due to inflated costs, 78% of respondents say they now view fast-food as a luxury. The percentage increases to 80% or higher among those making less than $30,000 a year.”

These high food costs have been largely caused by the food industry increasing prices faster than their costs.

Americans are largely supportive of efforts to regulate how much companies charge for food. In a new Data for Progress poll, 69% of respondents said the government “should do more to regulate grocery stores that raise prices to maximize profits.”

Sad to say, the Democrats will not do anything meaningful to bring down the cost of food.

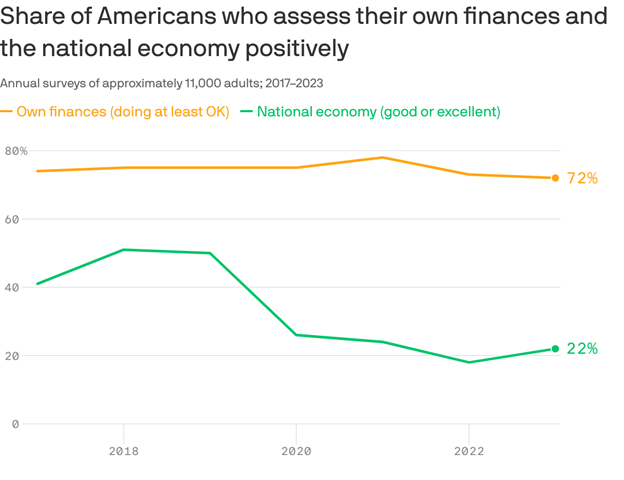

And the higher expense of putting food on the table may partly explain the so-called “vibecession”. There’s a great divide in the US between how people see their personal financial situation (pretty good) and their view of the overall economy (terrible). Here’s another chart:

Data: Federal Reserve Survey of Household Economics and Decisionmaking; Chart: Axios Visuals

In the above poll by the Federal Reserve, respondents are asked to choose from four options when it comes to how they’re doing. The top two choices were “living comfortably” and “doing OK.” 72% of Americans landed in those categories.

Respondents are also asked about the financial well-being of the national economy — the top two choices, “excellent” and “good,” were chosen by only 22% of Americans. In addition, that gap between people’s perceptions of their financial well-being and that of the national economy has nearly doubled since 2019. From Axios: (brackets by Wrongo)

“This divide is showing up in plenty of surveys. The University of Michigan Consumer Sentiment Index for May [2024] came in lower than 84% of readings since 1978….Just 22% of respondents to a May Gallup poll said they were satisfied with the way things were going in the US, compared to 77% dissatisfied. That’s a wider gap than three-quarters of the time since they started asking the question in the 1970s. A Harris poll last month showed that 56% of Americans think we’re in a recession.”

Brian Beutler reminds us that if Trump were in office today — presiding over full employment while Americans enjoyed more purchasing power than ever before, and inflation was hovering steadily around three percent — he and Republican politicians would claim credit for building the greatest economy in US history.

But Biden and his handlers are vacillating about how to address the economy’s perception gap. From Beutler:

“Nevertheless, the emerging Democratic consensus seems to be that Biden should continue to ‘meet people where they are’: sympathize with the plight of the struggling, implicitly concede that the economy—which would poll through the roof with Republicans stealing credit for it—is actually bad.

Within the White House…aides are pushing for a message that makes empathy toward the economic plight of certain Americans more central….Some noticed a preview…when the president described the April inflation report…‘I know many families are struggling, and that even though we’ve made progress we have a lot more to do.’”

That can’t be right if we can swap Republicans for Democrats without changing anything else, and the perception gap would somehow magically go away.

But Biden shouldn’t be speaking as though the economy is one where more people need help when the truth is that fewer people need it. That would affirm the false notion that economic suffering is broadly based and something must be done to alleviate it.

The WaPo’s answer was an editorial saying that “Nearly everything Americans believe about the economy is wrong”. The same issue also had a story saying that people can’t make ends meet.

Are both of those things simultaneously true? Politicians better figure out which is primary (great economy) and which is secondary (bad personal financial situation).

We know that people are struggling to pay rent and mortgages and now, fast food’s a luxury. This is what is making many people think that this is the worst economy ever. And if you look closely this isn’t just “anecdotal”. The statistics supplied above seem to bear it out in some detail.

Biden needs to brag about the economy but he also must call out the food industry, and show people who are struggling that he’s trying to help.

Though as complete and cogent as any, Wrongo’s is not the only media voice to articulate his conclusion that Dems need to find a way to address the widespread and stubborn belief that “the economy is terrible.” The challenge is to find brief, insider-jargon free messages that will effectively communicate with people who don’t spend hours of most days reading the nation’s best newspapers or listening intently to leading analyists on reputable TV or radio outlets (i.e., most of us).

James Carvelle made a very smart and very specific suggestion recently. He urged Democratic campaign committees at both national and state levels to pass out FILE CARDS to all their best wordsmiths and ask them to craft brief, punchy messages to communicate the Biden administration’s important messages.