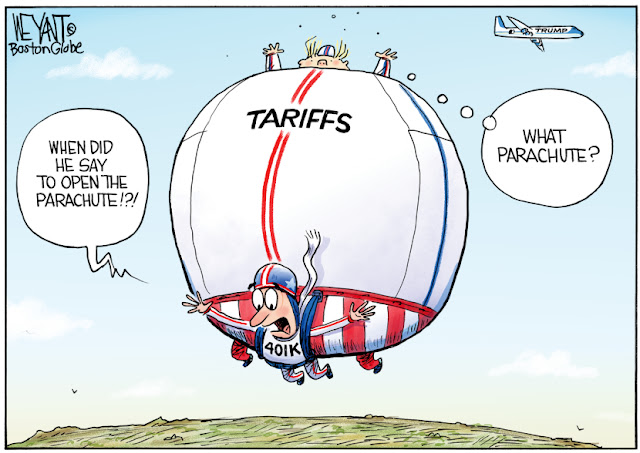

The Daily Escape:

You cannot negotiate with a market. You can manipulate it, but in the long run markets do what they do. From the NYT :

“A sharp sell-off in US government bond markets and the dollar has set off fears about the growing fallout from President Trump’s tariffs, raising questions about what is typically seen as the safest corner for investors during times of turmoil.

Yields on 10-year Treasuries — the benchmark for a wide variety of debt — whipsawed on Wednesday after Mr. Trump paused the bulk of the levies he had threatened the week before and raised the rates charged on Chinese goods after that country retaliated. The reversal sent U.S. stocks soaring.”

And the bond market is not having any of Trump’s nonsense. We nearly had a major financial crisis. This is the part you don’t know. The bond markets freaking out means that, unchecked, we were maybe a week away from possible bank failures.

We’re talking about the market for US Treasury bonds—normally among the safest assets in the world. They started convulsing, along with the stock market. The yield on 10-year Treasuries leapt to 4.5%, up from 3.9% days earlier. That meant bond prices, which move inversely to yields, had cratered. The failure of both risky and supposedly safe assets at once, threatened to destabilize the financial system itself.

Why did the bond markets start to collapse? There was a technical reason, which was that losses in the stock market were so severe and widespread that hedge funds needed to sell bonds to cover losses. And money managers moved away from the slumping US dollar.

But more than that was a general, widespread loss of confidence In the US itself.

So what happened was something like this. Whatever sane minds are in the Oval Office probably desperately tried to warn Trump that we were indeed likely just a few days away from bank failures. That if the catastrophic fire-sale of US government bonds didn’t stop, the consequences would be ruinous.

“William Cohan had an excellent explanation last night of where the bond market is after Trump’s tariff pause”:

The bond market can be broadly understood as a device that measures risk. The riskier an economic environment is, the higher the yield on bonds goes.

Over the course of Trump’s brief tariff regime the 10-year yield on T-bills went from 3.86% to 4.54% —a 17.6% climb in less than a week. That’s a screaming klaxon alarm.

Yesterday, after Trump announced his 90-day pause, the yield only dropped back to 4.4%. Which suggests that the bond market was not especially reassured.

One of the big risks is China. China holds $760b in US Treasuries. Should the Chinese decide to lower their purchasing of T-bills at the next auction, that will drive up the yield as the Treasury Department has to make them more attractive in the face of slackening demand. Which would in turn ratchet the entire bond market up another level of fear.

Why do bonds matter? Because bonds are how people finance debt—they are a rough approximation of the belief that it is safe to extend credit. And without credit, financial markets can’t function.

It’s all about risk. From Larry Summers: (emphasis by Wrongo)

“Long-term interest rates are gapping up, even as the stock market moves sharply downwards. This highly unusual pattern suggests a generalized aversion to US assets in global financial markets. We are being treated by global financial markets like a problematic emerging market.”

Donald Trump’s erratic and foolish actions have turned America, the most desirable financial haven in the world, into a whirlpool of risk. The safest way to conduct business now is to limit exposure to the US to the greatest extent possible. From the NYT: (emphasis by Wrongo)

“The chaos that has followed last week’s announcement has made companies wary about adding more upheaval with a drastic change to their supply chains. Faced with constant flux and unpredictability, companies are choosing to stay with what they know: longstanding relationships with Chinese suppliers or manufacturing partners.”

Driving multinationals deeper into relationships with China is not the art of the deal. It’s the destruction of stability and the start of a long, slow slide into a vortex.

Consider if you were to make an offer to buy a house: Would your opening bid be 50% of the asking price and would you expect a counter-offer? No, that’s bad faith negotiating. That’s pretty much what this tariff rollout has been like. “Let me start with the most ridiculous thing I can come up with and see if they bite!” The seller would tell you to go F yourself and find someone else to buy the home.

The whole world is going to do this. We’re going to carve ourselves out of a seat at the table.

Let Scott Galloway have the last word:

“The definition of stupid is hurting others while hurting yourself. Let’s hope the Republicans riding shotgun will realize the guy with his hand on the wheel is crazy.

My prediction: Xi will not back down. With Trump, he’s come to the same conclusion as Succession’s Logan Roy re his own kids: ‘You are not serious people.’”