The Daily Escape:

The Oberlausitzische Library of Science, Gorlitz Germany

There is a growing concern that the mall as we know it is in big trouble. RadioShack, The Limited, Payless, and Toys“R”Us were among 19 retail bankruptcies this year. From Dave Dayden: (brackets by the Wrongologist)

This story is at odds with the broader narrative about business in America: The economy is growing, unemployment is low, and consumer confidence is at a decade-long high. This would typically signal a retail boom, yet the [retail store] pain rivals the height of the Great Recession.

Many point to Amazon and other online retailers as taking away market share, but e-commerce sales in the second quarter of 2017 were 8.9% of total sales. There are three reasons for so many sick retailers.

First, while online sales are “only” 8.9% of total retail sales, these businesses have very high fixed costs and low net profit margins. The Stern School at NYU tracks net profit margins on thousands of businesses across many sectors, including retail. The margins for Specialty retail for the year ending January 2017 was 3.17%. It was 1.89% for Grocery and 2.60% for General retailers. If a high fixed cost business loses 9% of sales, it can easily wipe out the bottom line.

Second, many retail companies carry high debt levels. Bloomberg explains that private equity firms (PE’s) have purchased numerous retail chains over the past decade via leveraged buyouts, where debt is the primary source of the money used to buy the business. There are billions in borrowings on the balance sheets of troubled retailers, and sustaining that load is only going to become harder if interest rates rise.

Third, there are just too many stores in our cities and suburbs to sustain sales in a world where online shopping is growing rapidly.

Worse, billions of dollars of that PE-arranged debt come due in the next few years. More from Bloomberg:

If today is considered a retail apocalypse…then what’s coming next could truly be scary.

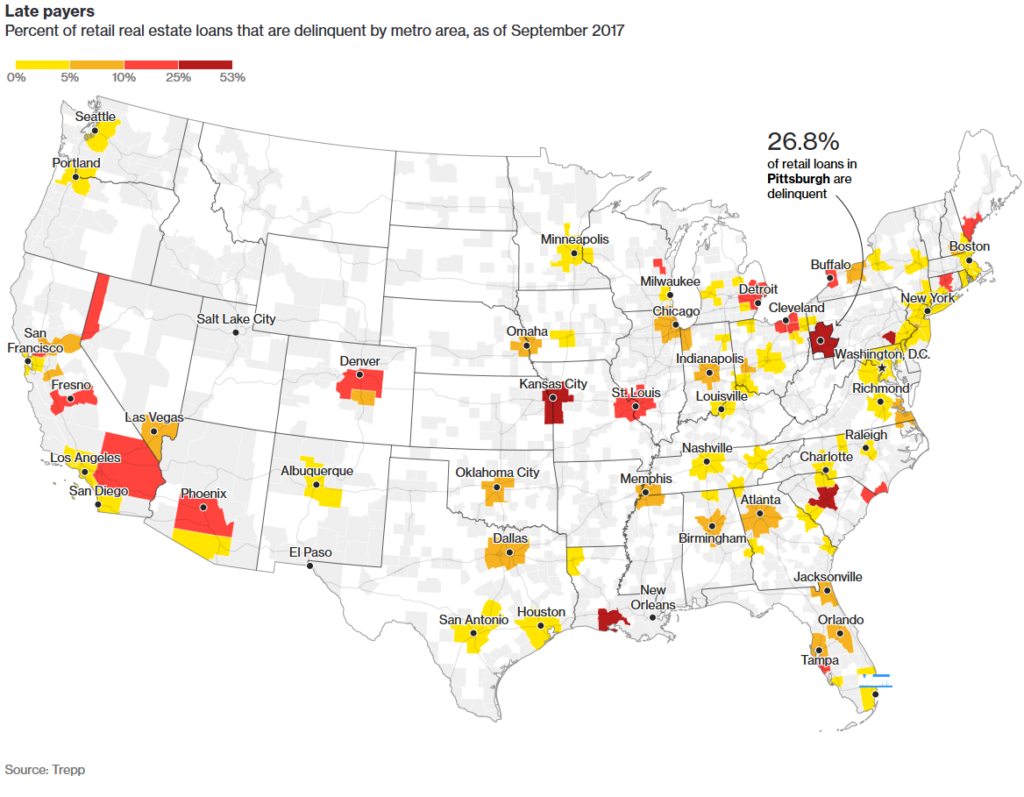

This chart shows what percentage of retail real estate loans are delinquent by area:

Source: Trepp

There are large areas of America where more than 20% of the loans are past due. More from Bloomberg: (emphasis by the Wrongologist)

Through the third quarter of this year, 6,752 locations were scheduled to shutter in the US, excluding grocery stores and restaurants, according to the International Council of Shopping Centers. That’s more than double the 2016 total and is close to surpassing the all-time high of 6,900 in 2008…Apparel chains have by far taken the biggest hit, with 2,500 locations closing. Department stores were hammered, too, with Macy’s Inc., Sears Holdings Corp. and J.C. Penney Co. downsizing. In all, about 550 department stores closed, equating to 43 million square feet, or about half the total.

This threatens the retail sales staff and cashiers who make up 6% of the entire US workforce, a total of 8 million jobs. These workers are not located in any one region; the entire country will share in the pain.

These American retail workers could see their careers evaporate, largely due to the PE’s financial scheme. The PE’s, however, will likely walk away enriched, and policymakers will share the blame since they enabled the carnage.

Our tax code makes corporate interest payments tax-deductible. So the PE kingpins load up these companies with debt and when they walk away, they get tax credits for any write-offs, incentivizing them to borrow and play the game again. The PE firm might lose some or all of its equity, but in most cases, it already drew cash out via special dividends and fees, so it has made its money.

The lenders, employees, state development authorities are the ones left holding the bag.

The GOP’s new tax plan proposes a cap on the deductibility of interest payments over 30% of a company’s earnings. But, the GOP left a loophole: Real estate companies are exempt from the cap.

Surprisingly, this benefits Donald Trump’s businesses! It also helps PE firms that split the operating side of the businesses they buy from the property side, as most do. They put the borrowing onto the property side, and continue to deduct the interest.

So financialization businesses like PE will continue to strip the value out of companies with hard assets.

Billions in asset-stripping and thousands of operations sent overseas. Labor participation rate is stagnant, yet we are assured that if we pass big corporate tax cuts, the US economy will grow fast enough to more than compensate for the losses.

What’s wrong with this picture?