The Daily Escape:

Arches NP, UT – September 2022 photo by Nathan Smith

It can now take longer than 10 years for a typical first-time US home buyer to afford the down payment on a modest house, so says S&P Global in a July report (registration required). From the report:

“By fourth-quarter 2022, it will take 11.3 years for a first-time homebuyer with median income to save for a 10% down payment. It will take this homeowner 22.6 years to save for a 20% down payment. Both are over twice their pre-pandemic rates of five and 10.6 years, respectively.”

S&P estimates that with house prices rising so quickly, down payments are now twice the amount that they were before the pandemic. They also estimate that 60% of households could be priced out of the housing market by Q4 2025.

The NYT also is looking at the US housing market. They say that the US has a deepening housing crisis, including an acute shortage of:

“small, no-frills homes that would give a family new to the country or a young couple with student debt a foothold to build equity…”

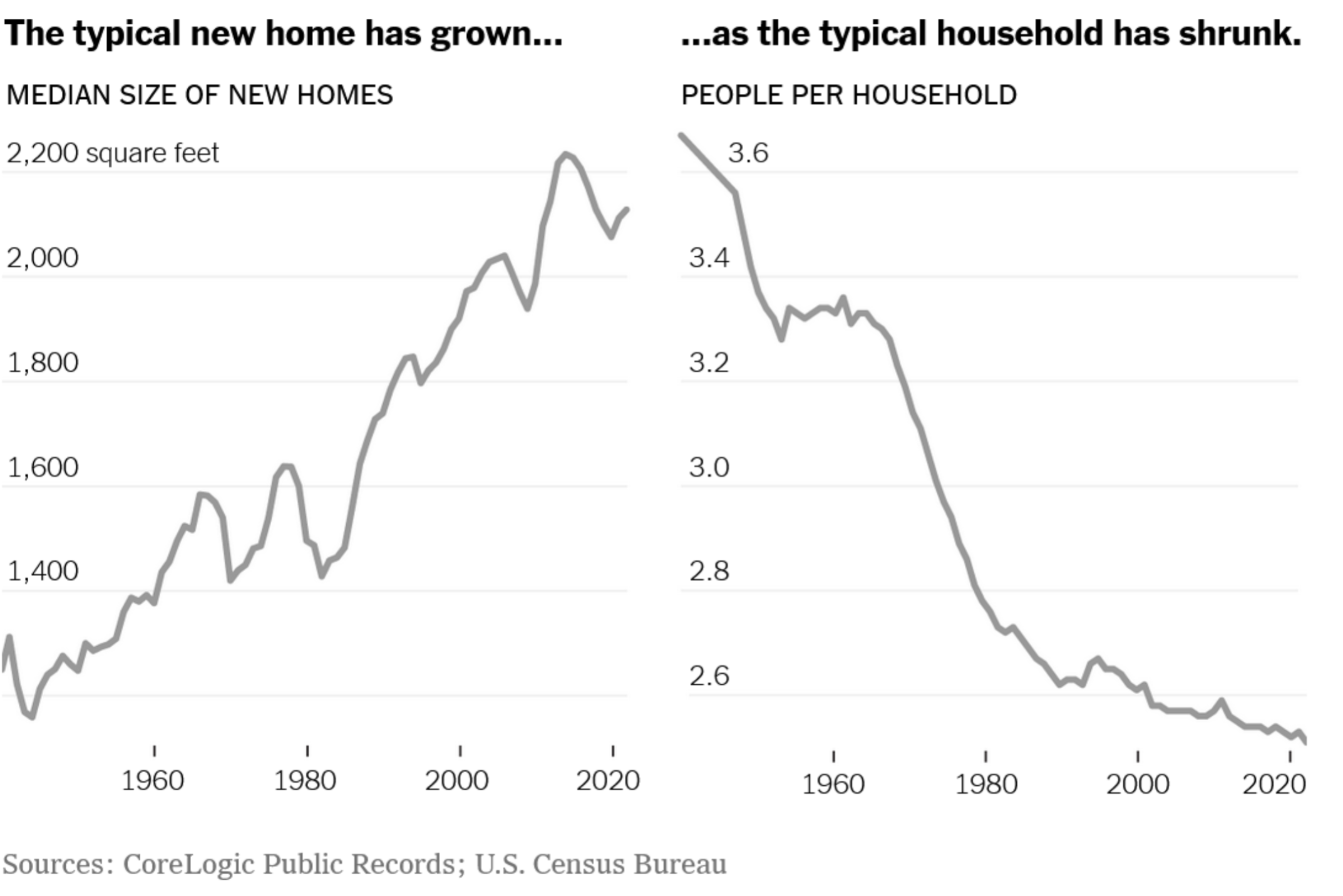

Factors include land costs, costs of construction materials and government fees. The typical new home has grown in median size over the past 60 years, while the average number of people living in each home has declined:

These long-term trends were accelerated by the pandemic, which drove up demand for homes and house prices as people scattered, worked from home, and snapped up second residences.

Local policies are also driving this new reality. The Times reports that communities nationwide:

“…are far more prescriptive today than decades ago….Some ban vinyl siding. Others require two-car garages. Nearly all make it difficult to build the kind of home that could sell for $200,000 today,”

So, high prices due to high demand. High mortgage rates due to the FED clamping down on inflation. And cities and towns making it more difficult to build low-end homes. On top of that, investors bought about a quarter of all single family houses sold last year.

Wrongo grew up when homes were affordable for a one-salary family. His 1,400 sq.ft. “starter home” in a tidy NJ suburb (walk to take the NYC train to Wall Street) cost $28,000 in 1970. We sold it for $38,000 in 1976. Zillow estimates that it would sell today for $647,000, 23 times what it did in 1969! It’s unbelievable how high home values in that neighborhood have risen.

Also, home buyer expectations are higher today. If a home doesn’t have an open floor plan, three bathrooms and granite countertops, most young buyers think they are settling for much less than they want.

Owning a home has been a part of the American Dream, but it’s one of the three legs of that dream that are currently being killed: (1) High housing costs (2) Stagnant wages and (3) High health-care costs. When you add college debt to the mix, you have the makings of a revolution against the 21st century’s form of capitalism.

Part of the American dream is for your kids to succeed. That starts with a good education in a school district that aligns with that goal. That can rule out most public schools in our larger cities. If young families can afford the costs of private schools in cities, they must be very well off.

The only way that most people can choose that kind of school is to look in the suburbs. Suburban school districts pay for their good schools with taxes on expensive homes. That means parents, and the local government all have a stake in keeping local property values as high as possible, thus the difficult zoning regulations that make houses larger.

But smaller homes are also desired by many retirees. People who are living out their golden years often want to “downsize” into an affordable small home, condo, or townhouse. Many of these developments are being built throughout America. They can be beautiful inside, but they are often attached or semi-attached boxes crammed together on land that was never supposed to be developed.

Time to wake up America! Today in most parts of the country there is hardly anything on the market for under $300,000. Not much that resembles the tidy starter home Wrongo purchased 52 years ago.

Affordable housing prices aren’t coming back without government intervention. America needs to look carefully at its housing policies along with how we have let financialization take over the housing market.

Financialization of housing refers to the increasing presence of corporations and organizations that are creating or using real estate management, mortgage processes, and financial instruments to profit-seek against individual homeowners.

To help you wake up listen to Buddy Guy perform “Gunsmoke Blues” along with Jason Isbell. The tune is highly relevant, and very powerful. It’s from Guy’s album ,“The Blues Don’t Lie” due out on September 30th:

Lyrics:

Trouble down at the high school

Somebody got the gunsmoke blues

Trouble down at the high school

Somebody got the gunsmoke blues

Read it in the morning paper

Watch it on the evening news

…

Some folks blame the shooter

Other folks blame the gun

But that don’t stop the bullets

And more bloodshed to come

A million thoughts and prayers

Won’t bring back anyone

In the mid 1960s when small foreign cars were entering the US market in larger number, I asked my father why America does not make small cars (this was just before the ill fated Vega and Pinto). My father was manager /bookkeeper for auto dealerships and he told me that there is not enough profit per car.

We tell ourselves a tall tale about competition and free markets. But while they are useful tools, even essential, they do not solve social problems.

Housing is a basic human need. We have seen the disappearance of modest housing for decades now. But as a nation we are stuck with the idea that there are market based solutions. Often they are not. If there were the market would already be doing this.

Excellent ideas about a societal that already Is impacting all of us, our children and grandchildren. God is not making more land, but we keep making more people. Malthusian economics would suggest either build more densely packed living situations ( taller or deeper), or control population growth. Or future technologies may solve the problem as well as bring an end to the American dream.