The Daily Escape:

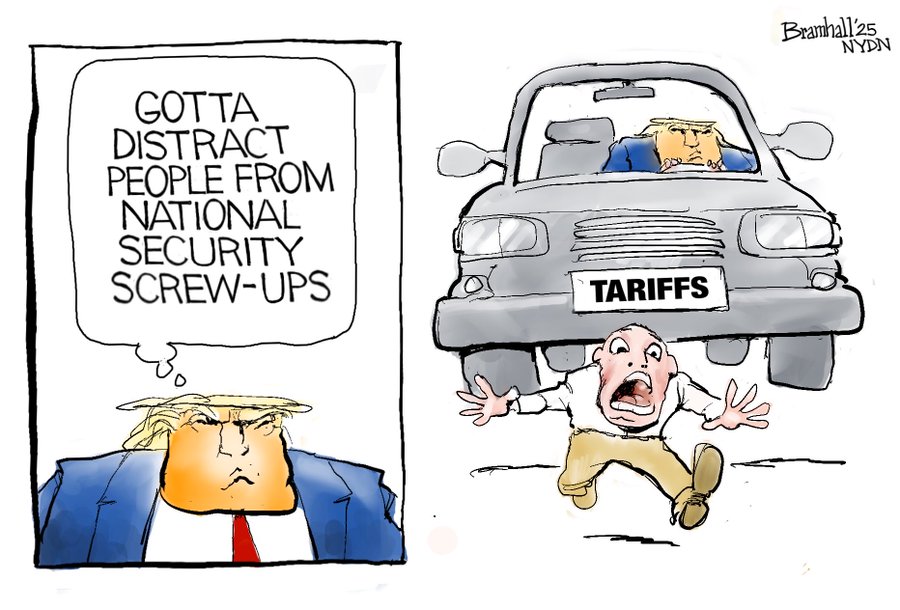

While Mike Waltz bumbles about in Washington, the special election for his old Congressional seat is drawing near: Floridians will go to the polls on April 1. That race was supposed to be a layup for Republicans, but some of them are starting to get pretty stressed about it.

In November, Waltz won his district by 33 points. But a new poll from St. Pete’s Polls in Florida has the race between Republican Randy Fine and Democrat Josh Weil within the margin of error. From Axios:

“Private GOP polling is even scarier for Republicans: A recent survey by Tony Fabrizio, who was a chief strategist for Trump in 2024, has Fine with just a three percentage point lead, according to a person familiar with the data.”

Per Florida Politics: (brackets by Wrongo)

“The results [in the St. Pete’s Polls] show Fine winning just over 48% of the vote, while Weil received just over 44%. The poll of 403 likely voters in CD 6 was conducted on March 22. Pollsters report a 4.9% margin of error, greater than Fine’s lead.”

It’s a tiny poll, meaning the results could go either way.

Axios also reported that among those polled who said they already voted, more than half supported the Democrat. Weil leads 51% to 43% among those whose decision has already been made via a mail-in ballot or in-person early voting. According to the survey, about 38% of likely voters have already cast their ballots in the race.

That means Fine will have to make up the difference with those who vote between now and the close of polls on Tuesday, if he intends to move into Congress. He has already submitted an irrevocable resignation letter from the Florida Senate to run.

Weil has also outraised Fine by a lot, hauling in almost $10 million—a large sum for such a small race.

Link that news up with Trump pulling Rep. Elise Stefanik’s (R-NY) nomination as UN Ambassador after last-minute panic about Fine’s electoral chances. More from Axios:

“Stefanik has waited for months on her nomination due to the House GOP’s tiny margin. The Florida special elections are Tuesday, but the administration has gotten cold feet about its margin ahead of crucial votes.”

Stefanik’s nomination as UN Ambassador was expected to move forward on Wednesday, April 2 — the day after the Florida specials, when the GOP would have added one seat to its slim majority. Stefanik had at least some bipartisan support in the Senate before the administration’s moves to completely dismantle the US Agency for International Development without any Congressional input or authorization. In response, some Democrats have subsequently vowed to block all Trump nominees for key foreign policy posts. This could gum up the works for a Senate confirmation for Trump’s next UN pick even if it turns out to be Stefanik.

Politico reports that for the past several months:

“Stefanik had held briefing sessions to dive deep on pressing international policy issues from China to the war in Sudan, according to three people familiar with the conversations. She also dispatched some of her closest aides in her congressional office to jobs at the State Department, including her deputy chief of staff…in preparation for her being confirmed as Trump’s UN envoy.”

Eventually Stefanik will leave the House, but It’s unclear if the Florida race is a harbinger for a tough midterm election cycle for Republicans, or just another case of a bad candidate screwing up a winnable situation.