“The illiterate of the 21st century will not be those who cannot read and write, but those who cannot learn, unlearn, and relearn” − Alvin Toffler

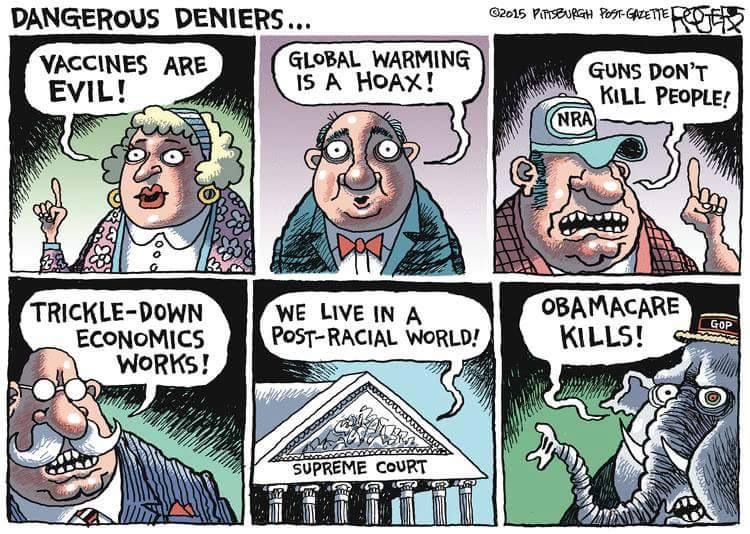

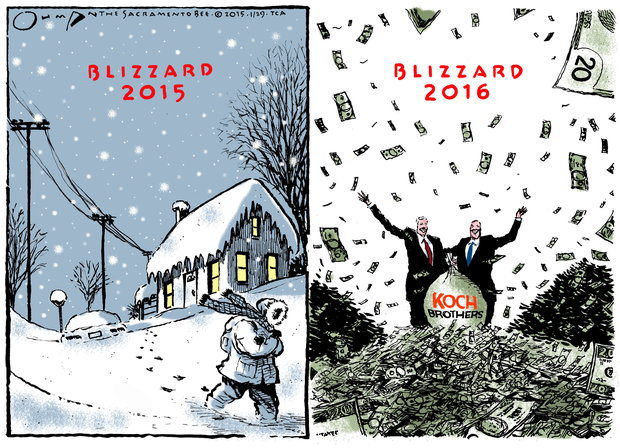

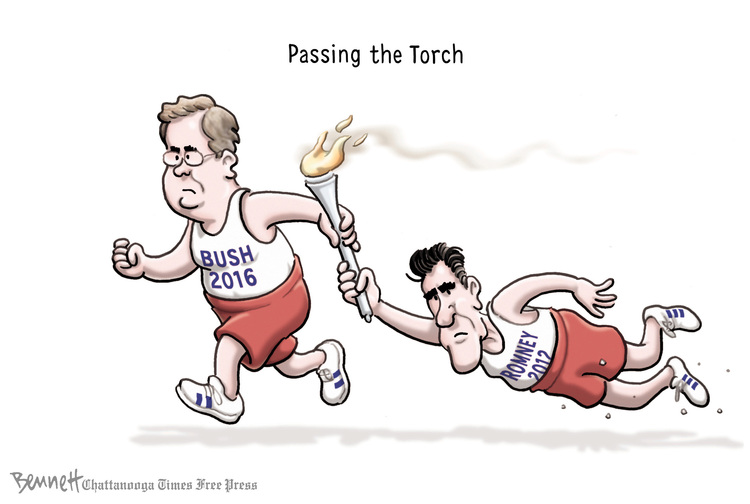

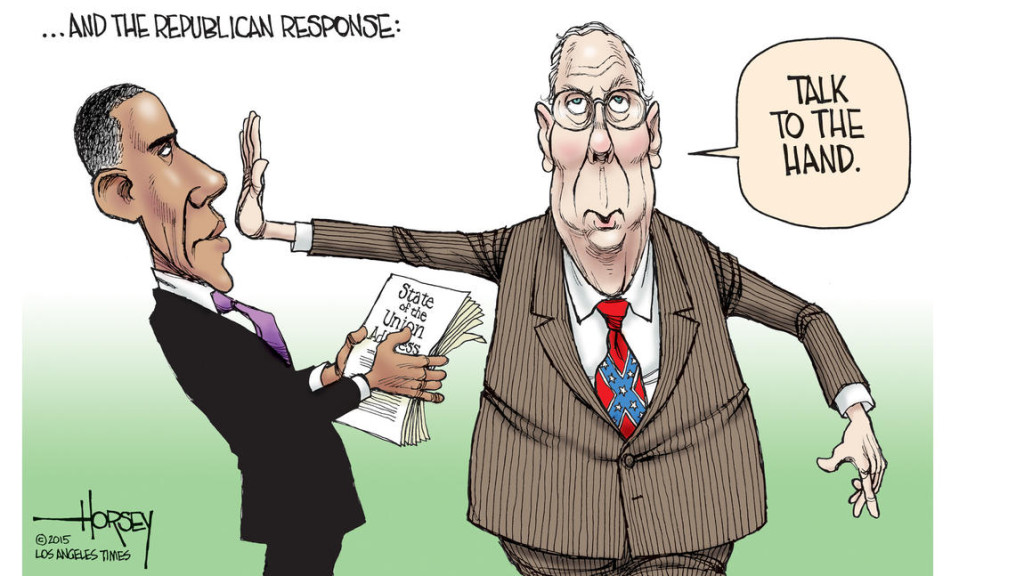

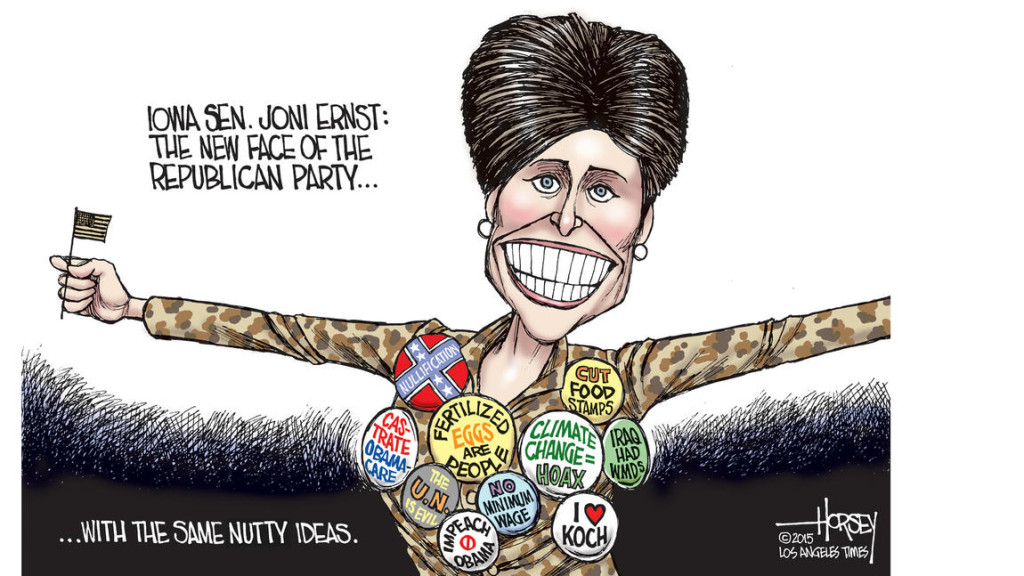

Today’s wake-up call is for Americans who can’t unlearn that trickle-down doesn’t work, and that voting in politicians who espouse it will prolong the nation’s agony. Do people know that the new GOP House began passing a series of deficit-hiking tax cuts that will primarily help the rich at the expense of everybody else?

Rep. Paul Ryan (R-Wis.), chairman of the Ways and Means Committee (which writes tax legislation), wants to make some previous tax breaks permanent. From HuffPo:

The House voted 272 to 142 to make permanent a number of temporary provisions that are aimed at helping businesses earning up to $2 million. The main cut, which would add $77 billion to deficits over 10 years, allows businesses to immediately write off new equipment purchases up to $500,000. Temporary versions of the measure have been passed about a dozen times before, generally as economic stimulus measures.

The GOP then passed a second tax cut, aimed at giving bigger tax breaks for charitable giving. Ryan wants even more tax cuts that would add another $300 billion to the deficit. Those may reach the House floor later this month.

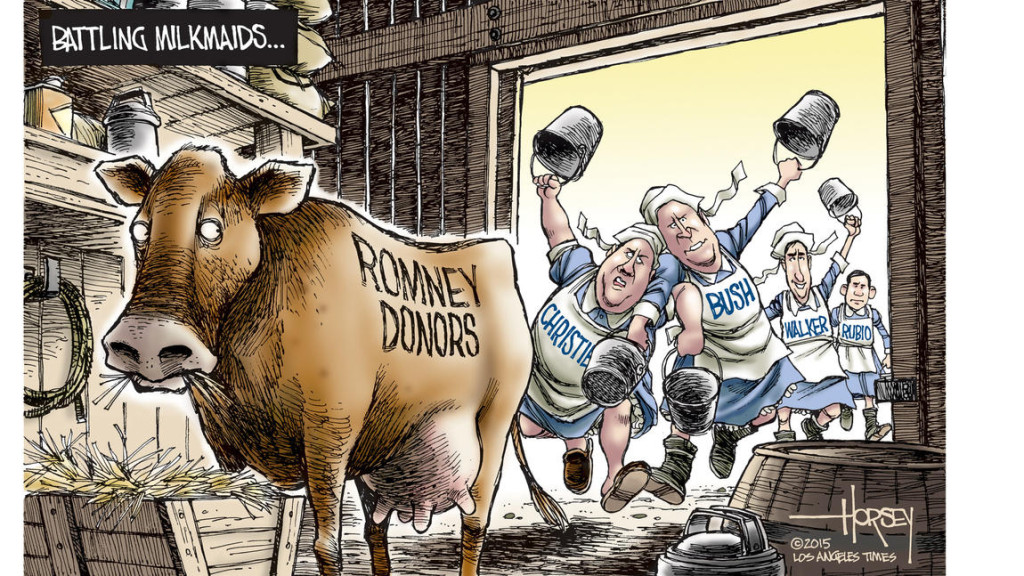

Here’s the Republican strategy: Slice the elephant and eat it a bite at a time. Pass small pieces of tax legislation while ignoring the deficit impact, then when their corporate and wealthy individual patrons are taken care of, remind everyone that the deficit is the biggest, baddest enemy the economy has. Then propose budget cuts that hit the working poor and the middle class. Ryan’s current strategy can be seen here: (emphasis by the Wrongologist)

If you dare try to make these things that we all agree on that need to stay in the tax code permanent, it’s ‘You’re not paying for it; it’s a budget buster; you’re being irresponsible; you’re jeopardizing tax reform.’ Process, process, process…Here’s the problem. What we’re trying to do here, we’re trying to grow the economy. We’re trying to get people back to work.

That meme will end soon. It will be replaced with: “growth is being stifled by the deficit”.

The NYT’s Upshot notes that a number of Republican governors are proposing tax increases — and in every case, the tax hike would fall most heavily on those with lower incomes, while they propose simultaneous tax cuts for business and/or the wealthy. Krugman analyzes it thusly:

If you look for an overarching theme for overall conservative policy these past four decades…It has been about making the tax-and-transfer system harsher on the poor and easier on the rich. In short, class warfare.

Class warfare. These folks keep bottling snake oil and voters keep buying it. Lowering income taxes on the wealthy doesn’t create jobs. Why would it? The focus of the GOP on cutting income taxes is solely intended to protect the rich.

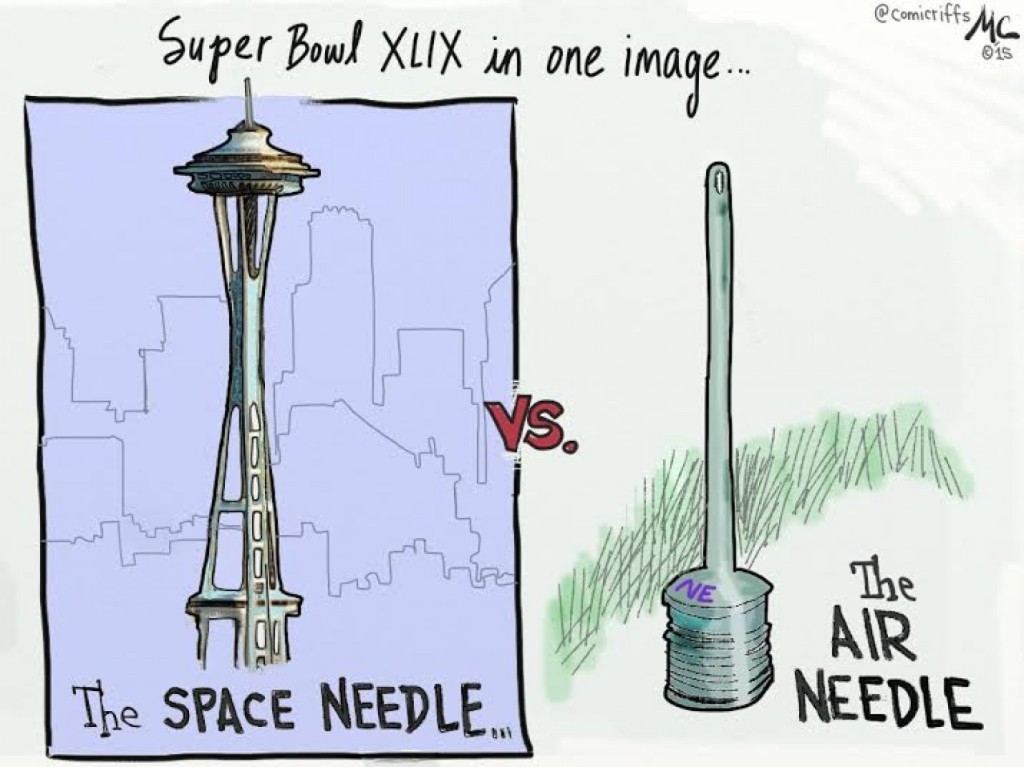

Wrongo has run businesses for 35+ years and never saw taxes as an impediment. Taxes are paid out of profits, not revenue, and paying taxes means you are running a profitable business. Cutting taxes for small business can be a disincentive: Why should the owners expand the business when their net is greater, and they didn’t have to increase sales? For large corporations, tax cuts mean that people in the C-suite get richer. Nothing. Filters. Down.

Here is your Monday tune to fight the Plutocracy. “Rich Man’s War” by Steve Earle, from his 2004 album, “The Revolution Starts Now”:

And some Monday hot links:

The Westminster Dog Show starts today. Wrongo and Ms. Oh So Right are attending.

Researchers are using drones and satellites to spot lost civilizations. Remote sensing technology is revealing traces of past civilizations that have been hiding in plain sight.

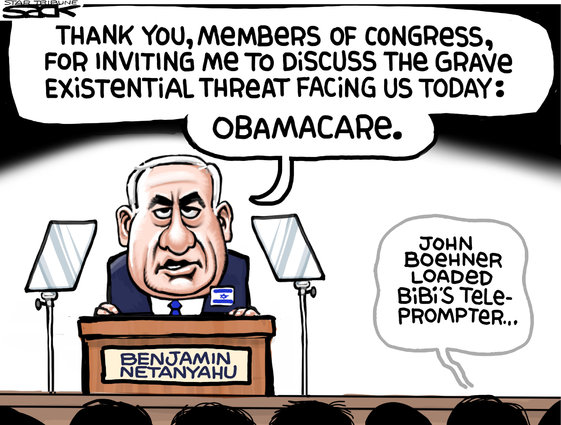

Lobbyists move though the revolving door back to House and Senate committees. There is a profound change taking place among Capitol Hill staff, as many GOP lawmakers are handing the keys to K Street corporate lobbyists. Public Citizen’s Paul Holman notes that Speaker John Boehner, has “encouraged new members to employ lobbyists on their personal and committee staff.”

More than 4,000 Fort Carson soldiers are heading to Kuwait, where they will become one of America’s largest ground forces in the troubled region. Did you know that the Army has kept a brigade in Kuwait since the end of the Iraq war in 2011?

Majority of public school students are now considered low-income. Another success brought to you by trickle-down economics.

Unaffordable rents here to stay say experts. They aren’t likely to ease up for at least two years, according to the latest Zillow Home Price Expectations Survey