The Daily Escape:

The start of US Highway 6, outside of Bishop, CA – September 2023 photo by Steve Wolfe

(There will be no Saturday Soother this week. Wrongo is on the road.)

Millions of older Americans from the Silent Generation and the Baby Boomers are facing a dilemma as they “age in place.” They must figure out how to pay for increasingly complex medical care. The NYT quotes Richard W. Johnson, director of the program on retirement policy at the Urban Institute:

“People are exposed to the possibility of depleting almost all their wealth….”

The prospect of dying broke is an imminent threat for the Boomers. About 10,000 of them turn 65 every day between now and 2030. They’re expecting to live into their 80s and 90s at the same time as the price tag for long-term care (LTC) is exploding. Currently LTC expense is outpacing inflation and approaching a half-trillion dollars a year, according to federal researchers.

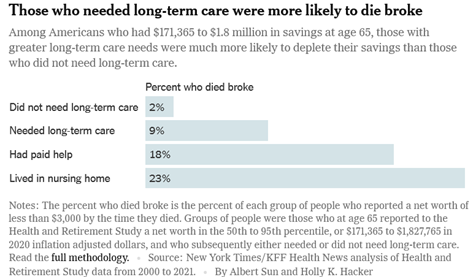

By 2050, the population of Americans 65 and older is projected to increase by more than 50% to 86 million. The number of people 85 or older will nearly triple to 19 million. The Times has a chart of how many of those who need long-term care will die broke:

Some older Americans have prepared for this possible future by purchasing LTC insurance back when it was still affordable. Since then they’ve paid the monthly premiums, even as those premiums continued to rise. But this isn’t the norm. Many adults have no plan at all or assume that Medicare, which kicks in at age 65, will cover their health costs. But Medicare doesn’t cover the kind of long-term daily care, whether in the home or in a full-time nursing facility, that millions of elderly Americans require.

For that, you either pay out-of-pocket or you spend down your assets until you have less than $2,000 in assets in order to qualify for Medicaid. Remember that Medicaid provides health care, including home health care, to more than 80 million low-income Americans.

And even if you qualify, the waiting list for home care assistance for those on Medicaid tops 800,000 people and has an average wait time of more than three years.

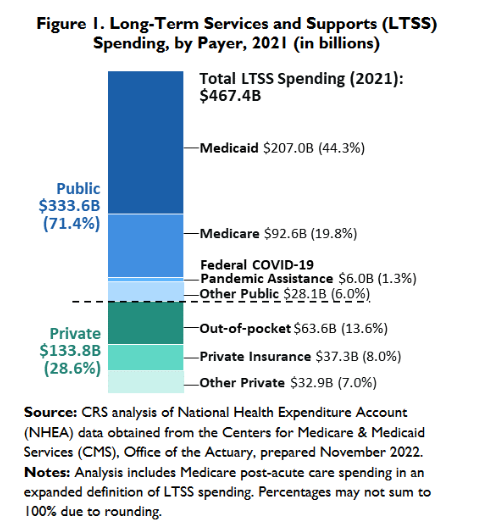

Here is a snapshot of how long-term care is paid for in the US:

Governments provide 71.4% of the total. The largest non-government source is people who pay out-of-pocket, and private insurance is becoming increasingly expensive. More from the NYT:

“The boomer generation is jogging and cycling into retirement, equipped with hip and knee replacements that have slowed their aging. And they are loath to enter the institutional setting of a nursing home. But they face major expenses for the in-between years: falling along a spectrum between good health and needing round-the-clock care in a nursing home.”

That has led them to enter assisted-living centers run by for-profit companies and private equity funds. The NYT says that about 850,000 people aged 65 or older now live in these facilities and when in them, they are largely ineligible for federal funds. Some facilities provide only basics like help getting dressed and taking medication while others offer luxury amenities like day trips, gourmet meals, and spas.

In either case, the bills can be staggering. More:

“Half of the nation’s assisted-living facilities cost at least $54,000 a year, according to Genworth, a long-term care insurer. That rises substantially in many metropolitan areas with lofty real estate prices. Specialized settings, like locked memory care units for those with dementia, can cost twice as much.”

Home care is costly, too. According to Genworth, agencies charge about $27 an hour for a home health aide. Hiring someone who spends six or seven hours a day cleaning and helping an older person get out of bed or take medications can add up to $60,000 a year.

It’s worse for people with dementia because they need more services. The number who are developing dementia has soared, as have their needs. Five million to seven million Americans over age 65 have dementia, and that’s expected to grow to nearly 12 million by 2040.

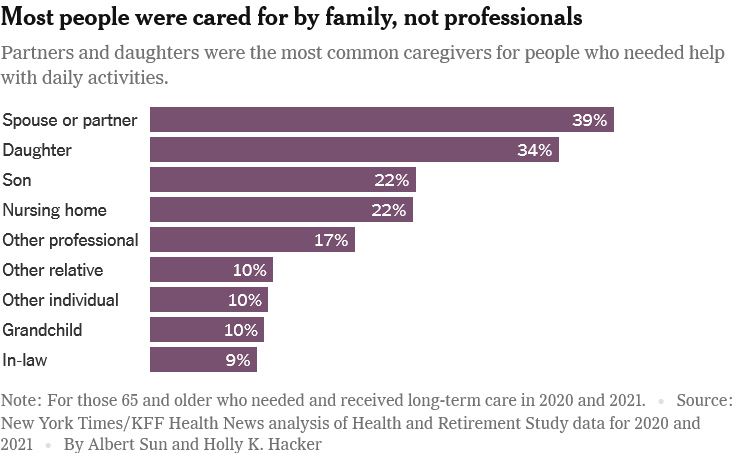

The financial threat posed by dementia also weighs heavily on adult children who in many cases become guardians of aged parents. The Times included this chart:

The reality is that families go broke either caring for, or finding care for their loved ones. The alternative: Women in the family give up their lives and jobs to care for their family members instead, which worsens the gender wage gap.

The NYT article makes it clear that older Americans receive far less government support than their peers in other countries. The “why” question is easily answered: It’s a combination of the concerted effort for any public support to be demonized as “welfare”. It’s also partly the result of our failed experiment with long term care insurance. The politicians’ idea was that “the market” would take care of it, so government help for retirees could be limited to Medicaid-paid nursing homes.

But, the LTC insurance industry has largely imploded. Insurers had little experience with the product and grossly overestimated the lapse rates. If a policyholder stops paying, the insurer gets to keep the money and use it to provide services to everyone remaining in the pool. The surprise was that very few people stopped paying. A second miscalculation was that people who held these policies were living longer than forecasted. Longer life equaled higher and larger payouts (insurers also benefit when customers die before they’ve used up all the policy benefits).

A final factor is the rising levels of dementia described above.

And since demand for support outside of family members exceeds the supply of beds, nursing homes and assisted living facilities that aren’t terrible want residents to join during the independent living phase (which requires very little care, so those fees subsidize intensive nursing home care). Many of these facilities require a $400,000-$500,000 buy-in, which may not be refundable at death, even if the resident is current on their monthly fees.

There’s got to be a better way. Medicaid can’t be the only option to pay for LTC. Congress needs to establish a better system for middle-class Americans to finance LTC.

How we handle the growing costs of long-term care is just another reminder that we get LITTLE for our tax dollars beyond a giant military. Americans are responsible for their own medical care, childcare, college tuition, retirement and nursing home care. Some or all of which are provided in other rich countries.

This is a loudly ticking time bomb, and the demographics of the problem won’t change for decades. And yet, the Republicans seem bent on making it worse. They’re actively trying to bring about their dream of privatizing Social Security and Medicare.

Wake up America! We have real problems to solve.

The dark or flip side of the modern medical technology miracle.

All this is just one reason why I fear and loathe efforts to increase the NATURAL life span (to say 120 years or even way beyond). If succesful this would be the biggest nightmare I can imagine (not just economically).