The Daily Escape:

Sunset, Thumpertown Beach, Eastham, MA – November 2023 iPhone photo by friend of the blog, KO.

We keep looking for good news that will buoy Biden’s polling numbers, and on Tuesday we learned that the Consumer Price Index (CPI) was flat in October. From Axios:

“Overall prices rose 3.2% in the 12 months through October, slowing from the 3.7% in September and well-below the peak levels reached last year. Core CPI rose 4%, compared to 4.1% the prior month.”

Among the good news was that last month, prices for gasoline and used cars and trucks fell outright, helping cool over inflation. Meanwhile, shelter costs rose at a much slower pace last month, possibly signaling that inflation could be ending in the next few months.

That gave investors reason to pile back into the stock market, since it may be a sign that the Fed won’t continue to raise interest rates.

But as always, analysis of the economic news could show why Biden polls so badly on the economy, and in particular why he hasn’t consolidated support among younger voters. Let’s take a different look at how some important economic indicators have performed under Biden.

From the Bonddad Blog:

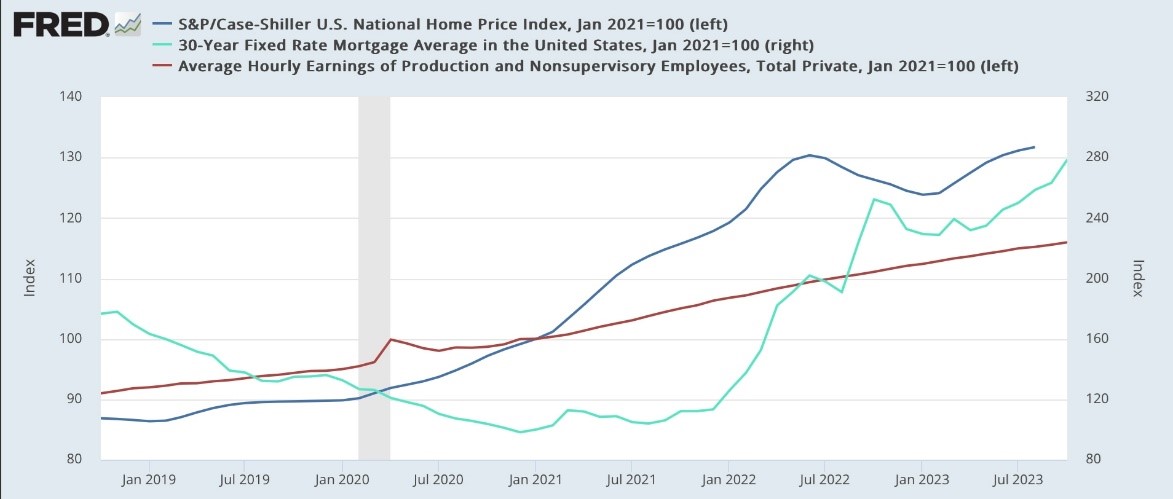

“Below is a graph in which I compare average hourly earnings (nominal, not real) for non-supervisory workers (in red) vs. house prices (dark blue) and mortgage payments (light blue).”

It is important to note that Bonddad has set all of the values to 100 as of January 2021 so that we’re looking only at what has happened during Biden’s Administration. Bonddad compares the changes in average hourly earnings to the rate of fixed price mortgages and the price of homes. These are nominal rates:

Average wages have increased 16% since Biden took office, but existing house prices have increased by 32%, and monthly mortgage payments for new buyers have increased 279% (!), from roughly 3% to roughly 8%. Housing is close to unaffordable for many in America.

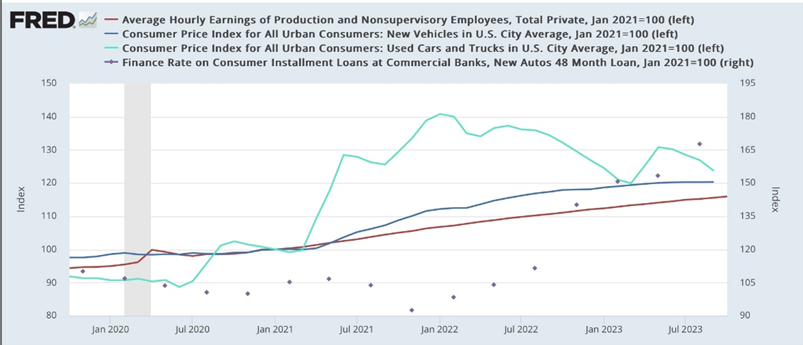

Turning to cars, new car prices have increased by 20%, and used car prices by 23%, compared to that 16% for wages. And new car loan payments (dotted line below) have increased almost 70% (from about 5% to 8.3%):

Houses and cars are the two biggest purchases that most average people make. And sorry to say, affording them has gotten much harder since Biden took office.

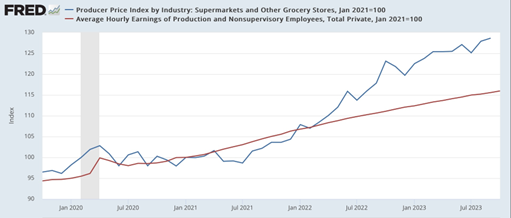

Finally, let’s look at the cost of two things people see every day: groceries and gas. First, grocery prices are up 29% since Biden took office in January 2021 (again, vs. 16% for average wages):

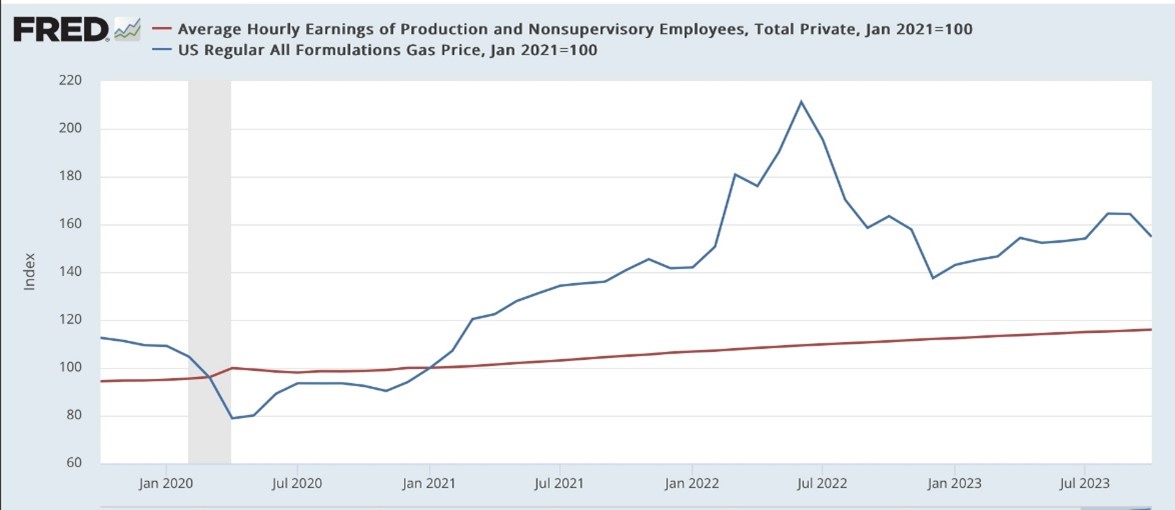

And gas prices, although they have come back down recently, are still up 55% since January 2021:

Looking at the economic data this way, would you be more likely to vote for or against Biden? This is a big Biden problem with voters who live paycheck to paycheck.

It’s hard to overstate the importance of viewing the Biden economic performance like Bonddad does above. Much of the blame for these specific price increases belongs to corporations who took advantage of the breakdown in the global supply chain to raise their prices. Some belongs to the Biden administration’s pumping money into the economy.

Bonddad provides a ton of perspective regarding how the Democrats shouldn’t be talking to voters about how fantastic the economy has become under Biden. Dems can’t simply talk about the aggregate economic numbers, since many will not fully believe them.

At the risk of piling on, Wrongo recently saw this October Experian survey which asked:

“I suffer or have suffered from financial trauma”

A staggering 68% of US adults replied that they had. You can view the survey here. The stress was felt more strongly by younger generations, namely Gen Z adults and millennials, with 73% of Gen Z’ers and 77% of millennials experiencing negative thoughts and/or anxiety about money.

The idea of “financial trauma” goes beyond mere stress. America’s seeing multiple social crises afflict it. Friendships are cratering, loneliness is soaring, deaths of despair are skyrocketing. Half of American young people say they feel “persistently hopeless.”

Now tie this to how the majority of voters are saying that America is on the wrong track. The prevailing attitude in America is that our systems are rigged against working people. If you work hard, play by the rules, try to be an honest, decent and productive person, but the reward is that you get financially, socially, emotionally traumatized, well, maybe you’d be pessimistic, too.

The result is that most Americans feel they are living precarious lives. When asked, they say they need north of $230K to feel “comfortable” while the average yearly income for a full-time worker is about $75,000 today. That means feeling stable and secure is completely out of reach for the vast majority of Americans.

Most of this happened over time and surely wasn’t caused by Biden, or the Democrats. And little of it can be fixed by him.

There’s some good news in the fact that history shows us that voters generally focus on how the economy has performed during the last 6 to 9 months before the election. In 2012, the economy improved a lot, and when the unemployment rate finally fell below 8% one month before the election, it helped Obama to get reelected.

On the flip side, the economy was weakening as we closed in on the presidential election in 2016. GDP growth and wage and job gains were weak. Strong stock market gains were a positive. Adding the pluses and minuses suggested that the economy was weak, and the insurgent Trump won the election.

Better news on inflation in 2024, particularly for groceries and gas, will mean Biden’s polling on the economy will be much better.

All this is worth considering but I still see as more important the infrastructure that fosters a climate of lies. This is an example from the Heritage Foundation:

It’s distressing to realize that the woman ostensibly in charge of the nation’s finances knows nothing about them—and the Treasury’s data prove it.

It’s no wonder that roughly half of Americans think we’re already in a recession when their personal finances have deteriorated so much so quickly.

The alternative assessment of Ms. Yellen’s words is equally troubling: she is well aware of the problem and is simply lying to the American people.

I remember being poor (because I tried for a career in the arts – dumb move). So until i was 32 I did not have a career path. so from 1976 to 83, I was broke and worked junk jobs. But even then i was less concerned about inflation than whether I had a job. And I kept moving from job to job. So today the younger voters will resent not being able to buy a house – but I still see the lies told as given and easy explanation for their personal difficulties.

It is always hard to counter an easy lie with a complex truth.

I just returned from the bank after opening a CD at 5%. Then I opened Wrongo’s analysis above. It was a powerful reminder that Biden and Dems generally can’t win only with votes from people like me, i.e., comfortable retirees. And that I must quit shouting at the TV when I see poll results about how many people think the economy is “terrible ” or “weak.” In short, thanks for resetting my viewpoint.

That’s Wrongo’s highest purpose and he managed to accomplish it today with this old fart.