The Daily Escape:

Thor’s Hammer, Queen’s Garden Trail, Zion NP, UT – September 2023 photo by Michelle Strong

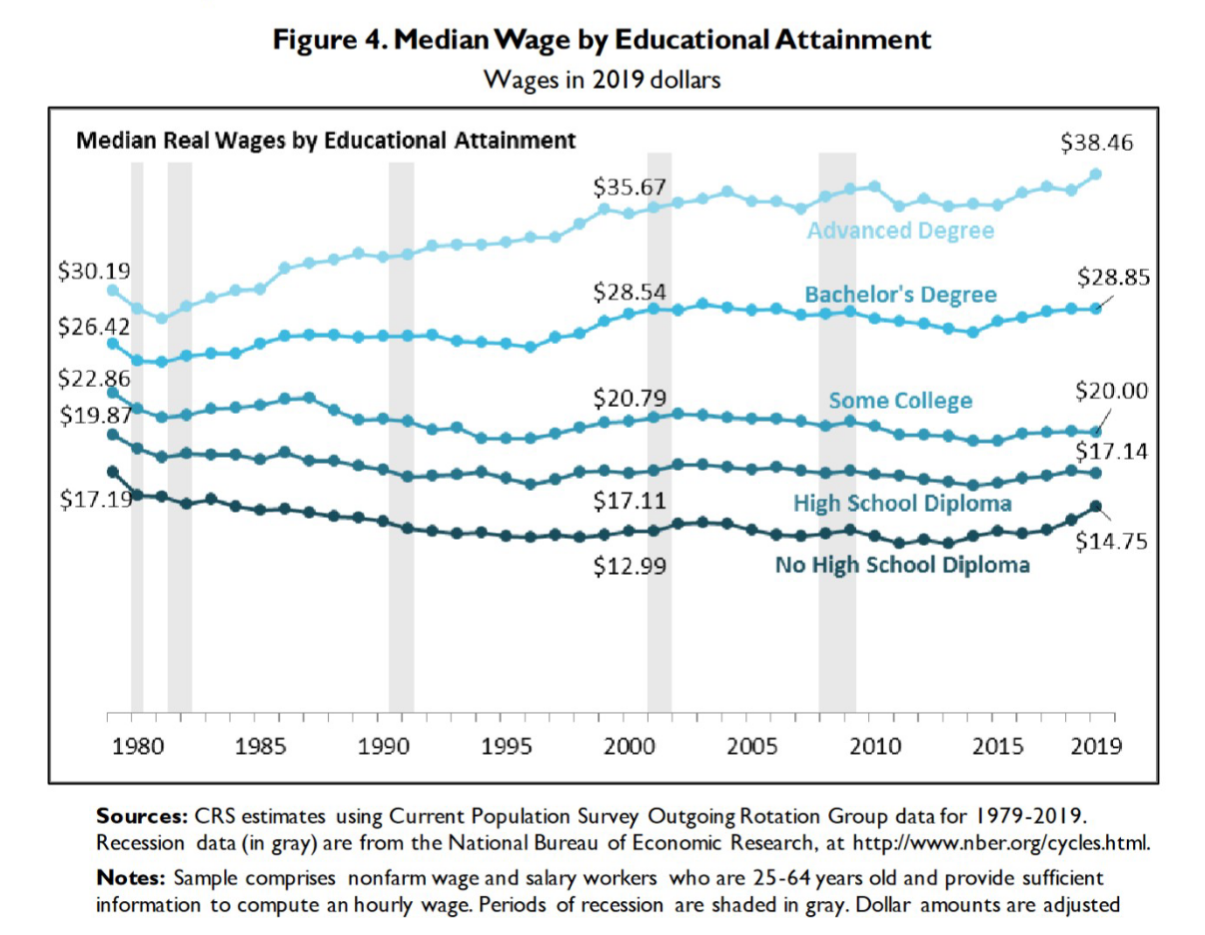

We all believe that college graduates make, on average, a lot more money than high school graduates. Economists call the gap that exists between the incomes of college graduates and high school graduates the college wage premium.

But, Paul Campos points out that in recent decades the growth in the college wage premium has been largely caused by declining wages for high school graduates, because wages for college graduates have been almost completely stagnant. For example, here is the Congressional Research Service’s (CRS) median hourly wage in 1979 and 2019, (40 years apart) for someone with a Bachelors degree (in 2019 dollars):

1979: $26.42

2019: $28.85

But it’s worse than that: Over the last 20 years of that 40 year period, the median hourly compensation of people with four-year college degrees increased by a total of $0.31, or 31 cents, just over a penny per year.

From Campos:

“The flip side of all this is that wages have declined for people who have gone to college but either not gotten a degree, or not gotten more than a two-year associate’s degree, falling from $22.86 in 1979 to $20.00 in 2019. And the decline has been even sharper for those with high school diplomas or less — thus driving up the “degree premium” for several decades’ worth of college graduates whose own compensation has not actually gone up, even as the cost of their degrees has gone through the roof.”

Here’s a chart from the CRS:

For both high school and no high school diploma categories, wages have fallen in absolute terms. So as college costs have risen, the college wage premium has stayed about the same because wages for the less educated have fallen dramatically.

As the NYT explains, the college wage premium has one important limitation:

“…It can tell you how much college graduates earn, but it doesn’t take into account how much they owe — or how much they spent on college in the first place.”

The NYT explains how a group of economists devised another way to look at the relative value of a college education: The college wealth premium. The wealth premium is the measure of how much more wealth college graduates can expect to accumulate as opposed to those with no more than a high school degree: (emphasis by Wrongo)

“Then the researchers looked at the wealth premium, and a different picture emerged. Older white college graduates, those born before 1980, were, as you might expect, a lot wealthier than their white peers who had only a high school degree. On average, they had accumulated two or three times as much wealth as high school grads of the same race and generation. But younger white college graduates — those born in the 1980s — had only a bit more wealth than white high school graduates born in the same decade, and that small advantage was projected to remain small throughout their lives.”

More: (emphasis by Wrongo)

“When the researchers looked at young Americans who had gone on to get a postgraduate degree, the situation was even more dire. ‘Among families whose head is of any race or ethnicity born in the 1980s and holding a postgraduate degree, the wealth premium is … indistinguishable from zero,’ the authors concluded. ‘Our results suggest that college and postgraduate education may be failing some recent graduates as a financial investment.’”

This means that Millennials with college degrees are earning a good bit more than those without, but they aren’t accumulating any more wealth. We all know why:

“The likely culprit…was cost: the rising expense of college and the student debt that often goes along with it. Carrying debt obviously diminishes your net worth through simple subtraction, but it can also prevent you from taking important wealth-generating steps as a young adult, like buying a house or starting a small business.”

Since 1992, the sticker price has almost doubled for four-year private colleges and more than doubled for four-year public colleges, even after adjusting for inflation. Over the last 15 years, more young Americans have borrowed to cover those rising costs. From the NYT:

“In 2007, total student debt stood at $500 billion. Today it is $1.6 trillion….Among student borrowers who opened their loans between 2010 and 2019, more than half now owe more than what they originally borrowed.”

When you factor debt into the equation, the financial benefit of a college education begins to look very different. The NYT reports on Douglas Webber of the Federal Reserve, who found that the premium now varies much more than it used to:

“The “downside risk” to enrolling in college, he argues, has become “nontrivial.”

When you look at Webber’s data, higher education is a financial gamble that can still sometimes produce a big windfall, but it can also bring financial disaster:

“If your tuition is free and you can be absolutely certain that you’re going to graduate within six years, then you enter college with a 96% chance that your gamble is going to pay off, meaning that your lifetime earnings will be greater than those of a typical high school graduate.”

But going to college isn’t free. If you’re paying $25,000 a year in tuition and expenses, Webber calculates that your chance of coming out ahead drops to about 66%. At $50,000 a year in college costs, your odds are no better than a coin flip: Maybe you’ll wind up with more than the typical high school grad, but you’re just as likely to wind up with less.

Americans can count, so they are aware that college education has become a financial gamble. They understand that going into high five-figures of debt (that doesn’t go away in bankruptcy) in order to earn a 5-figure salary doesn’t make a lot of sense.

In 2009, 70% of that year’s high school graduates went to college. In the fall of 2010, there were more than 18 million US undergraduates. It’s been falling ever since, dipping below 15.5 million undergrads in 2021. The percentage going straight to college is now 62%.

This tracks polling. In 2019, the percentage of young adults who said that a college degree is very important fell to 41% from 74%. About one-third of Americans now say they have a lot of confidence in higher education. Among Gen Z, 45% say that a high school diploma is all you need today to “ensure financial security.” And almost half of American parents say they’d prefer that their children not enroll in a four-year college.

But, education is an essential pillar of our democracy. The rejection of higher education by so many should be extremely concerning for the future of our nation. You should read the NYT article. Here are Wrongo’s conclusions:

- Colleges and universities are pricing themselves out of the market. Pigs get fat; hogs get slaughtered.

- Turning higher education into a revenue-maximizing enterprise for the benefit of these institutions is a social disaster.

- Higher education’s leadership has zero accountability for their role in making a college education so expensive.