The Daily Escape:

Sunrise, Cundy’s Harbor, ME – May 2024 photo by Eric Storm Photo

Economist Gabriel Zucman is a proponent of a global wealth tax. His column in the NYT explains what that is and how it would work:

“Until recently, it was hard to know just how good the superrich are at avoiding taxes. Public statistics are…quiet about their contributions to government coffers….Over the past few years…scholars have published studies…attempting to fix that problem. While we still have data for only a handful of countries, we’ve found that the ultrawealthy consistently avoid paying their fair share in taxes.”

The problem of billionaires paying very little in taxes is international. In the US, the problem is that billionaires rarely have any salaries to speak of:

”Why do the world’s most fortunate people pay among the least in taxes, relative to the amount of money they make? The simple answer is that while most of us live off our salaries, tycoons like Jeff Bezos live off their wealth. In 2019, when…Bezos was still Amazon’s chief executive, he took home an annual salary of just $81,840. But he owns roughly 10% of the company, which made a profit of $30 billion in 2023.

If Amazon gave its profits back to shareholders as dividends, which are subject to income tax, Mr. Bezos would face a hefty tax bill. But Amazon does not pay dividends to its shareholders. Neither does Berkshire Hathaway or Tesla. Instead, the companies keep their profits and reinvest them, making their shareholders even wealthier.

Unless…Bezos, Warren Buffett or Elon Musk sell their stock, their taxable income is relatively minuscule. But they can still make eye-popping purchases by borrowing against their assets. Mr. Musk, for example, used his shares in Tesla as collateral to borrow $13 billion to put toward his acquisition of Twitter.”

Slashing the corporate tax rate and getting rid of the estate tax have also had dire effects in terms of wealth distribution:

“Historically, the rich had to pay hefty taxes on corporate profits, the main source of their income. And the wealth they passed on to their heirs was subject to the estate tax. But both taxes have been gutted in recent decades.”

In 2018, under the Trump administration, the US cut its maximum corporate tax rate to 21% from 35%. And the estate tax has almost disappeared. Relative to the wealth of US households, it generates only a quarter of the tax revenues it raised in the 1970s.

The effective tax rate (the percentage of someone’s total income that they paid in taxes in all forms) is now lower for the 400 richest American billionaires than it is for the bottom 50% of income earners. Here’s the effective tax rate in 1960 and 2018 for these two groups respectively:

Source: NYT

The US national debt is $35 trillion, almost all of which we acquired during the same period as the reduction of taxes on the rich. That isn’t a coincidence. And since capital and people are both completely mobile, the problem of taxation of wealth doesn’t end at our borders. More from Zucman:

“There is a way to make tax dodging less attractive: a global minimum tax. In 2021, more than 130 countries agreed to apply a minimum tax rate of 15% on the profits of large multinational companies. So no matter where a company parks its profits, it still has to pay at least a baseline amount of tax under the agreement.”

Zucman is proposing we apply a similar minimum tax to billionaires:

“Critics might say…this is a wealth tax, the constitutionality of which is debated in the US. In reality, the proposal stays firmly in the realm of income taxation. Billionaires who already pay the baseline amount of income tax would have no extra tax to pay. The goal is that only those who dial down their income to dodge the income tax would be affected.”

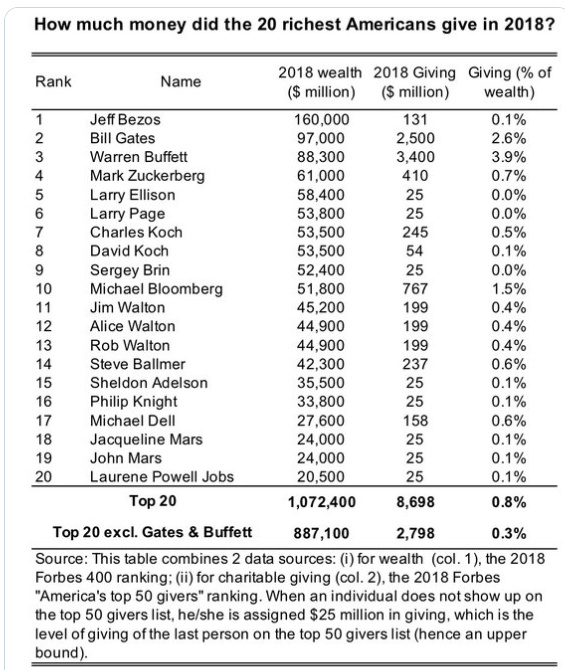

Critics of a minimum tax say it would be hard to apply because wealth is difficult to value. But according to Zucman’s research, about 60% of US billionaires’ wealth is in stocks of publicly traded companies. The rest is mostly ownership stakes in private businesses, which can be assigned a value by comparing them to the value of similar firms.

But the big issue is how to get broad international participation in this billionaire’s minimum tax. In the current multinational company minimum tax agreement, participating countries are allowed to overtax companies from nations that haven’t signed on. This incentivizes every country to join the agreement or lose tax revenue.

The same mechanism could be used for billionaires. For example, if Switzerland refuses to tax the superrich who live there, other countries could tax them on its behalf. Countries such as Brazil, have shown leadership on the issue, and France, Germany, South Africa and Spain have recently expressed support for a minimum tax on billionaires.

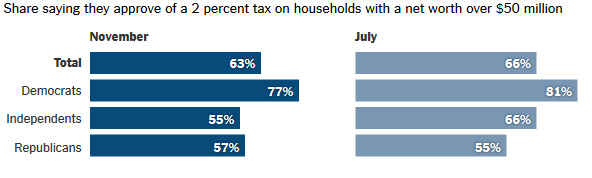

This is far from a done deal, although Biden has proposed a billionaire tax with similar objectives. And Zucman’s proposed tax wouldn’t impact the ordinary rich. He says there are about 3,000 people who would be required to give a relatively small bit of their profits back to governments.

Zucman’s closing words:

“The idea that billionaires should pay a minimum amount of income tax is not a radical idea. What is radical is continuing to allow the wealthiest people in the world to pay a smaller percentage in income tax than nearly everybody else.”

Great idea, one that almost everyone agrees with, EXCEPT those who have the power to do something about it. We’re looking at you, Republicans! Also, when a significant percentage of the (relatively) poor in this country support Trump who is dedicated to cutting taxes for the rich, is there any hope that taxes will be raised on the wealthy?

That’s more than enough thinking for this week. It’s time for our Saturday Soother, where we attempt to ignore the latest about the campus protests, or whatever else Gov. Kristi Noem is training her gun at, and gear up for another week in the political and cultural wars.

Here on the Fields of Wrong, the crab apple trees are in full bloom along with our weeping cherries. There is still plenty to do if we are to finish our spring cleanup before summer.

But, before we start down that backbreaking path, let’s grab a mug of coffee and a seat outside. Now watch and listen to Luigi Boccherini’s “Guitar Quintet No. 4 in D major “Fandango”, G.448”, recorded in the Unser Lieben Frauen Church, in Bremen Germany in 2019. Boccherini was an Italian composer and cellist. He wrote a large amount of chamber music, including over one hundred string quintets for two violins, viola and two cellos: