The Daily Escape:

Winter Morning, Moscow Oblast, Russia – 2018 photo by kostya8. Good luck to those in New England today!

“Shortly, the public will be unable to reason or think for themselves. They’ll only be able to parrot the information they’ve been given on the previous night’s news” – Zbigniew Brzezinski

Did Wrongo ever tell you about meeting Zbig? We had lunch together in the officer’s dining room at the big NY bank that Wrongo was with, sometime in the early 1980’s. It must have been a real comedown for him, lunching with an international department strategic planner, after serving four presidents. We focused on the (then) current state of the Asian economies, but his eyes scanned the room, looking (maybe hoping) for a better deal than simply talking to a young vice president.

Zbig’s quote is on the money. It is America today: We don’t figure things out, because everyone is an expert. Today, anyone you meet already knows everything. They’ve taken a quick look at Wikipedia, and they know that their opinions are worth as much as any expert.

If average people can be experts, why is Trump’s effort to do a better deal on trade so off the mark?

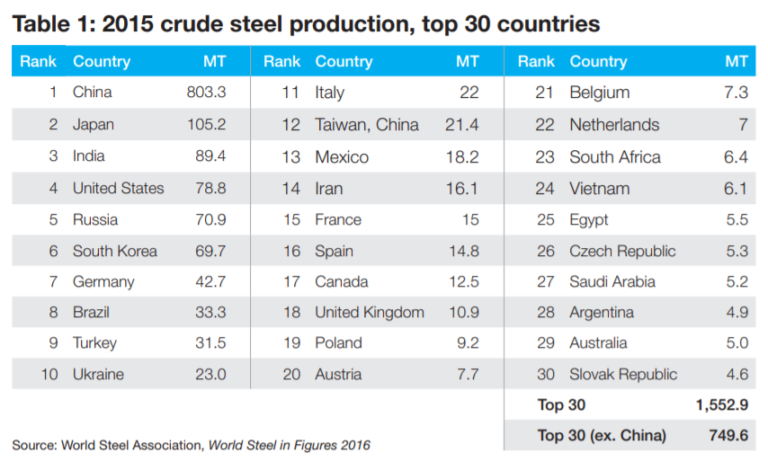

His proposed steel and aluminum tariffs are levied against all producers. The table below from a 2016 Duke University study, shows production by country. You can see the extent to which China is an outlier:

Note that the US is fourth on the list. Take a look at where Canada ranks. It’s hard to see Canada as a strategic risk to US military needs, but since Trump plans to deploy a blanket steel tariff, everyone suffers, at least until the retaliation begins. The Duke study makes the point:

The global steel sector is once again in a state of overcapacity. The sector, predominantly fueled by China’s expansion since 2000, has grown to over 2,300 million metric tons (MT) while only needing 1,500 MT to meet global demand. The result is a global steel sector at unviable profit levels and an influx of cheap steel in the global trading system adversely affecting companies, workers, and the global trading regime.

Both George W. Bush and Barack Obama applied steel tariffs. Bush imposed broad tariffs of up to 30% on steel imports in 2002. His tariff was supposed to last three years, but was withdrawn after the World Trade Organization (WTO) ruled against them. In 2016, the Obama administration imposed duties on some Chinese steel imports by more than 500%, on Chinese cold-rolled steel, which is used to make appliances, cars and electric motors. Subsequently, Chinese imports to the US dropped by almost two-thirds. China now ranks as the 11th largest exporter of steel to the US.

WaPo notes that Chinese steel accounts for about 6% of US steel imports, but China’s capacity is eight times that of the next biggest producer, Japan. Clearly, its Chinese capacity that must be addressed.

On Tuesday, the European Commission announced it had renewed tariffs on Chinese steel imports, some as high as 71.9%, saying producers in France, Spain and Sweden face a continued risk of imports from China at unfairly low prices. The Commission concluded that Chinese producers had significant spare capacity. This was likely to lead to large-scale imports into the European Union at dumped prices if the measures were lifted.

And even though China’s share of the EU market for stainless steel seamless pipes and tubes has hovered around 2% since 2013, Brussels had no problem with pursuing what it thought was a fair remedy, despite the possibility of blowback.

Ironically, that’s similar to what Trump says he wants to do. Similar, but far from the same.

Trump’s plan hits all global steel producers, not just China, which, as the chart above shows, produces 52% of the world’s supply. So instead of confronting only China, we will face blowback from everyone.

OTOH, the politics of Trump’s tariffs may play out differently than the economics. The economics suggest they are a loser. According to a January Bureau of Labor Statistics report, about 377,000 Americans work in metal manufacturing jobs that could be protected by these tariffs.

That’s a lot of votes in the Rust Belt. And the steel company CEO’s will also see bigger bonuses.