The Daily Escape:

A 20 feet x 9 feet sign placed in Times Square, NYC in Sept. 2013. Created by Steve Lambert.

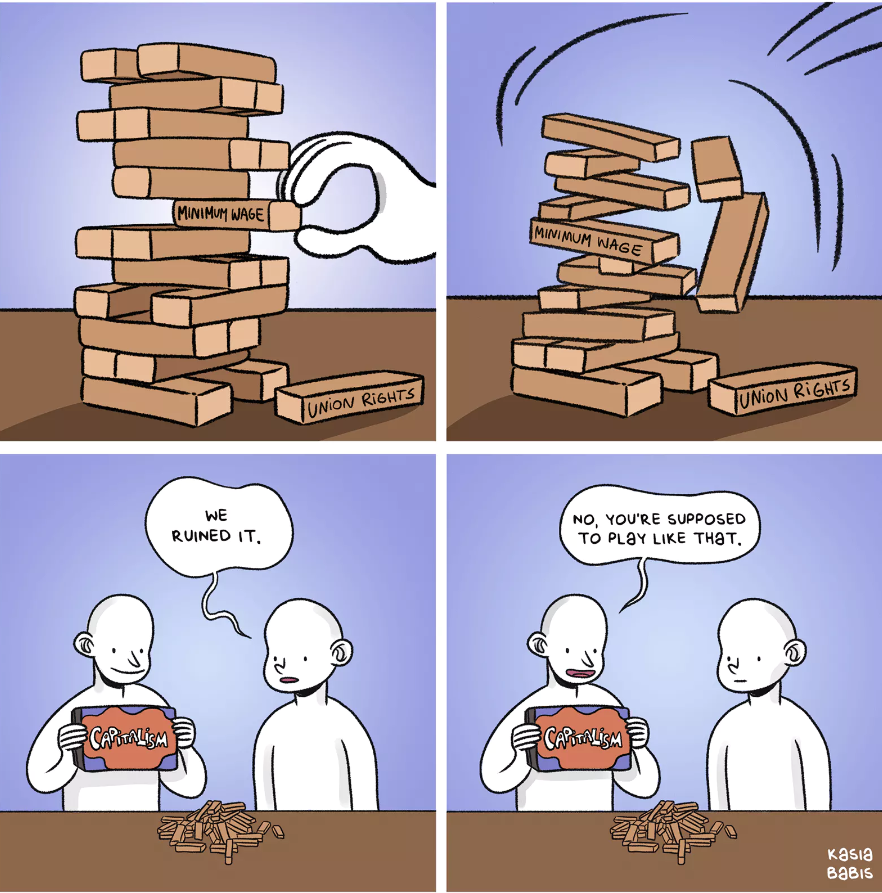

In yesterday’s column about Bed Bath and Beyond’s (BBBY) bankruptcy, Wrongo used the term “Late Stage Capitalism” to describe some of the factors that led to the firm’s demise. Several readers asked what Wrongo meant.

First, some history. A German economist named Werner Sombart seems to have been the first to use the term “Late Capitalism” around the turn of the 20th century. A Marxist theorist named Ernest Mandel popularized it in the 1960s. For Mandel, “late capitalism” described the economic period that started with the end of World War II and ended in the early 1970s, a time that saw the rise of multinational corporations, mass communication, and international finance.

In America the terms “Late Capitalism” and “Late Stage Capitalism” are used interchangeably. Late-stage capitalism is characterized by greed, corruption, and a focus on profits over people.

The current crisis of capitalism’s legitimacy stems from business pursuing the aberrant form of capitalism known as shareholder capitalism, which began in the 1970s. It causes firms to seek maximizing shareholder value as reflected in the current share price, at the expense of all other stakeholders and society.

Some of the problems with late-stage capitalism include wealth inequality, environmental destruction, and financialization. Financialization refers to the increase in size and importance of a country’s financial sector relative to its overall economy. In the US, the size of the financial sector as a percentage of GDP grew from 2.8% in 1950 to 21% in 2019. The financial services industry, with its emphasis on short-term profits, has played a major role in the decline of manufacturing in the US. Financialization has created “unproductive” capitalism. According to economist Michael Roberts: (brackets by Wrongo)

“…financialization is now mainly used as a term to categorize a completely new stage in capitalism, in which profits mainly come not from…production, but from financial [engineering]

Today, capitalism is no longer the heart of a free market. Algorithms run the stock and foreign exchange markets. Large players in these markets operate freely with the expectation that they will eventually be caught. They then pay off the DOJ or SEC, chalking up the fines to the cost of doing business.

Lobbyists on Capitol Hill curry favor with politicians. Companies then receive substantial tax breaks and move their ever larger profits to offshore tax havens. The revolving door between Wall Street and the banking sector allows former Federal Reserve Chairs to charge speaking fees of $500,000 and earn seats on the boards of the algorithmic trading firms. The Pentagon continues to benefit from budgetary increases while the profits of Boeing, Lockheed Martin, and other defense contractors continue to swell.

Late stage capitalism helped create the current distortion of wealth. From the wealthy one percent living in multiple homes and flying private, to the plight of the working poor in America. In a 2020 survey by Edelman, a marketing and public relations firm, 57% of people worldwide said that:

“capitalism as it exists today does more harm than good in the world”

When you have money, capitalism is your wing man. It opens doors to business leaders and helps develop political influence, all with the goal of amassing more wealth and power.

Late stage capitalism has allowed oligopolies and the oligarchs that run them, to rig the system in their favor. They’ve won Supreme Court cases, such as Citizens United v. FEC (2010), that give corporations the same speech rights as people, allowing them to spend millions on political ads to elect compliant politicians.

In recent years, capitalism’s shortcomings have become more apparent: Prioritizing short-term profits has sometimes meant that the long-term well-being of society and the environment has lost out. Indeed, if you judge by measures such as inequality and environmental damage, as economists Michael Jacobs and Mariana Mazzucato wrote in their book “Rethinking Capitalism”:

“…the performance of Western capitalism in recent decades has been deeply problematic…”

There’s also no denying that this strain of capitalism has led to increased economic growth worldwide, while lifting a significant number of people out of poverty. At the same time, its tenets of lowering taxes and deregulating business has done little to support investment in public services, such as crumbling public infrastructure, improving education and mitigating health risks.

Watch Paul Tudor Jones, a successful hedge fund manager describe why we need to rethink capitalism:

He’s concerned about capitalism’s laser focus on profits. He says that it’s:

“….threatening the very underpinnings of society.”

More people are aware of the term “late, or late-stage capitalism,” due to the growing wealth gap. People now have access to information that exposes the defects of capitalism, and the effects of political and elitist interference in the monetary policy of a country. There is a popular Reddit community devoted to it.

And calling something “late” implies the potential for significant change or revolution, A “late” period always comes near the end of something. Calling it “Late capitalism” says:

“…This is a stage we’re going to come out of at some point…”

Perhaps we’re on the cusp of society dictating that capitalism provide us with a more equitable way of life. Or maybe the wealth gap will continue to grow, and the corporations will continue to seize more power.

Whenever late-stage capitalism eventually comes to an end, you can be sure of one thing – it won’t be a soft landing.

Sources and reading list:

https://wrongologist.com/2023/04/bed-bath-and-beyond-another-retailer-bites-the-dust/

https://en.wikipedia.org/wiki/Werner_Sombart

https://www.theatlantic.com/business/archive/2017/05/late-capitalism/524943/

https://www.investopedia.com/terms/f/financialization.asp

https://www.linkedin.com/in/prof-michael-r-roberts/

https://www.fec.gov/legal-resources/court-cases/citizens-united-v-fec/

https://www.bbc.com/future/article/20210525-why-the-next-stage-of-capitalism-is-coming

https://www.edelman.com/sites/g/files/aatuss191/files/2020-01/2020%20Edelman%20Trust%20Barometer%20Global%20Report.pdf

https://www.reddit.com/r/LateStageCapitalism/

Alternative Views:

https://tomdehnel.com/crushing-the-myth-of-late-stage-capitalism/

https://www.nytimes.com/2023/04/20/opinion/american-capitalism-good.html